With Aroha Capital Investment Advisers, you partner with a ‘skin-in-the-game’ investment advisory. We help you understand your financial position, guide you through investment decisions, and help you realize your financial goals.

WHY AROHA

Problems

- Lack of fiduciary intent and conflicts of interest in advice

- High transaction costs and commissions

- Tax inefficiency

Principles

- Fiduciary standard

- Process driven (goal-based and risk-based)

Portfolio Creation

- Tailor made for client’s unique needs

- Low churn and tax efficient

- Simple and low cost

OUR SERVICES

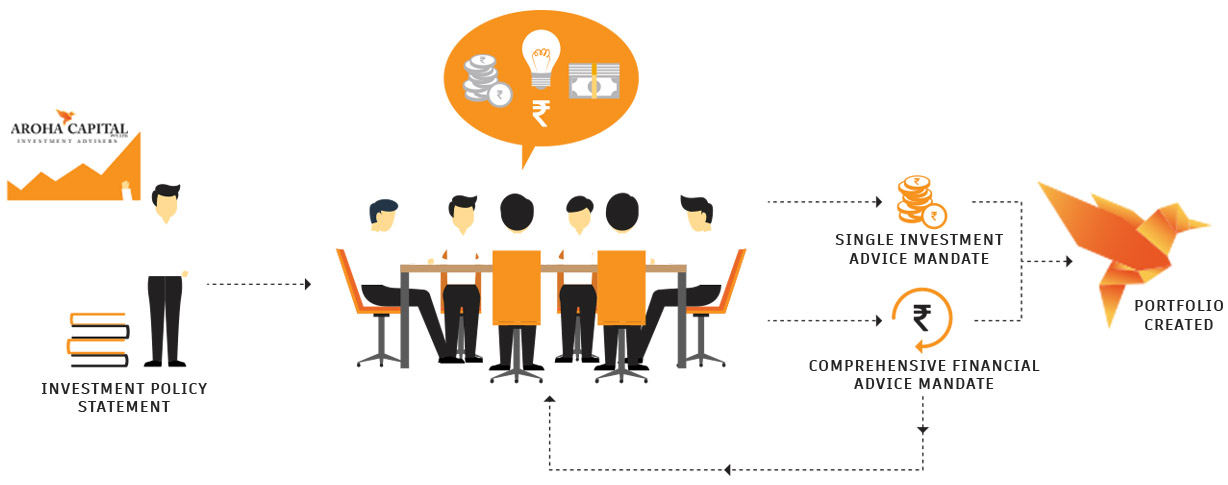

At Aroha, the starting point is the Investment Policy Statement. Here we articulate a framework of how your investments should be structured such that your financial goals are met in harmony with your appetite and ability for financial risk.

After this, you can either choose a Single Investment Advice Mandate or a Comprehensive Financial Advice Mandate.

BENEFITS

Focus on your unique needs

We lay emphasis on a client’s unique situation and ensure low transaction costs.

Partner with a SEBI-Registered Investment Adviser

We are a SEBI-regulated entity; our processes are designed to follow fiduciary standards.

Avail a Skin-in-the-Game Partner

We eat our own cooking.

ABOUT AROHA

Aroha Capital Investment Advisors is a fee-only, SEBI-registered Investment Adviser (registration no.: INA200000175). Incorporated on 11 February 2013, the firm is headquartered in Bengaluru.

LEADERSHIP

Vivek Pai, CFA

Managing Director and Principal Officer

Experience:

Experience:

- Self taught finance professional investing in capital markets since 1999

- Founded Aroha Capital in 2013

Education:

Education:

- Chartered Financial Analyst, CFA Institute