with Sahil Chhabria - A level graduate, Vidyashilp Academy, Bangalore

Term life insurance policy:

Term life insurance provides life insurance coverage for a specified term. Term life insurance lasts for a specific time period – this is called the term of the policy. The policy holder pays premiums (annually or monthly) to the insurance company during the term of the policy. If the insured has an untimely death, within the term of the policy, the nominees of the insured would receive a pay out of the insured amount. For example, A is aged 40 and takes a term life insurance worth Rs 1,00,00,000/- for a term of 25 years (ie upto to age 65). If A dies at age 61, his nominees, will receive a pay out of Rs 1,00,00,000. However, if A does not die during the term of the policy, his term life insurance would lapse at the end of the term (age 65) and no sum is due either to A or his nominees. Thus, if A survives the term of the policy, he stands to lose all his paid premiums. Term life insurance policies do not accumulate cash value. Premiums on term life insurance, are flat throughout the term of the policy is significantly less expensive than traditional life policies. However, the premiums increase based on the age of the life insured at the point of initiating the term life insurance policy.

Limited premium paying term life insurance policy:

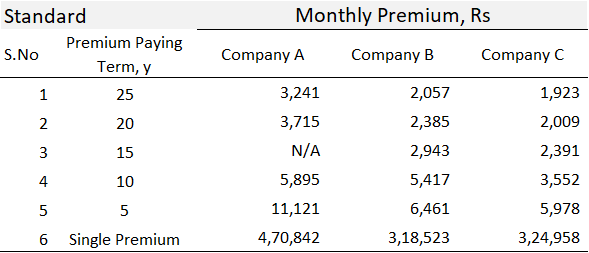

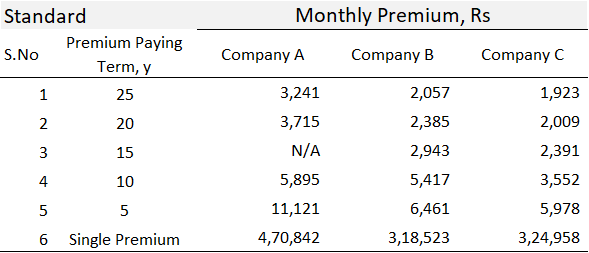

The standard version of a term life policy is for the premiums to be paid annually or monthly for the entire term of the policy. However, with innovations from insurance companies, policy holders now have the option of choosing limited premium paying term life insurance policies. In such policies, the premium paying term is lower than the policy term. For example, A takes a term insurance policy for 25 years and opts for a the limited premium paying term of 15 years. A thus has to pay premiums only for the first 15 years of the policy and for the remaining 10 years, the term life policy is still in force (ie A continues to retain his life insurance cover for the entire 25 year term). In the table below, a 25 year term life policy is considered. For this policy, the monthly premiums charged by selected insurance companies is tabulated for different premium paying terms ie : (25 years, 20 years, 15 years, 10 years and , 5 years and single premium)

Table-1: Monthly premium for simple 25 year term policy with different paying terms

Source : Website of various insurance companies

S.No 1 in Table-1 is the regular premium paying term option in which the policy holder has to pay premiums for the entire 25 year term for which he is insured. For example, A takes a term life insurance from insurance company C, with a premium paying term of 25 years. A's monthly premium would then be Rs 1,923/- for the next 25 years. All the other options (S.No 2 to 6) are limited premium paying terms in which the policy holder can pay premiums for a period less than the 25 year term of the policy i.e either (20,15,10,5 or single premium) years. It may be noted that the limited premium paying term options have higher premiums than the regular premium paying term option. In-fact, the premium progressively increases as the premium paying term reduces and is maximum for the single premium option.

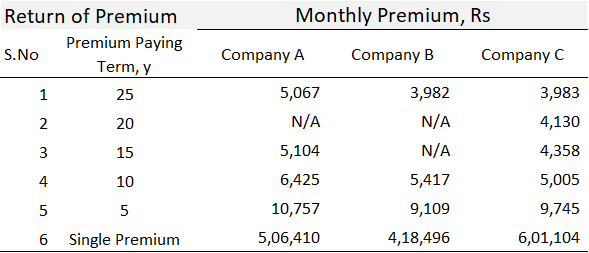

Return of premium term life insurance policy:

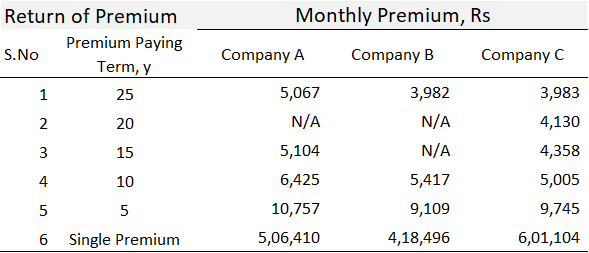

Insurance companies also offer term life insurance policies with an option of getting premiums back at the end of the term, in case the insured does not die. These type of term insurances are known as return of premium term life insurance policies. The premiums for such policies are drastically higher than premiums for regular term life insurance plans. In Table-2 below, premiums charged by various insurance companies for various term life insurance plans with return of premium option is presented . The premiums for simple term life insurances are substantially lesser than premiums paid for return of premium policies

Table-2:Monthly premiums for return of premium policies

Source : Website of various insurance companies

Comparing the various term life insurance options is very confusing for the lay investor. The subject of this article is to investigate these various term life insurance policies options and provide a methodology of how to choose the best option.

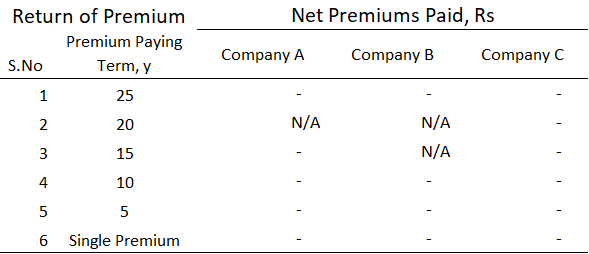

Comparing cost of policies with net premiums paid:

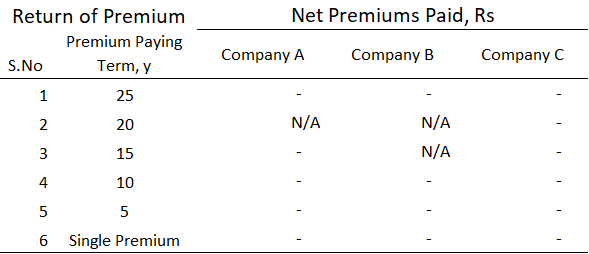

A simplistic approach to studying the various policy options is to consider the net premiums paid over the life time of the policy. Table-3 and Table-4 below calculate the net premium paid for standard term life insurance and return of premium options respectively.

Table-3: Net premium paid over the entire term of standard term life insurance policies

Table-4: Net premium over the entire term of return of premium term life insurance policies

Psychology behind choosing a policy option :

Consumers tend to consider the raw net cash out flow when comparing policies. For example an examination of Table-3 and Table-4 above indicate that the net cash out flow is highest for the standard term life insurance option (S.No 1 in Table-3), followed by the limited premium paying term life policies (S.No 2 to 6 in Table-3) and then followed by the lowest net cash outflow- being the return of premium policies (all Table-4 data points). In the return of premium term life policies, at the end of the policy term, the total paid premiums are returned and the net cash out flow from the policy holder is zero. The psychology behind consumers going for return of premium policies over simple term life insurance seems to be the security of the policy holder getting his/her premiums back. By getting all paid premiums back, it would seem to the consumer that he is effectively getting a Rs 1 cr term life policy for free (i.e net cash outflow is zero).

We set out to prove here in this article, that in selecting net cash out flow as a method to determine cheapness of a policy, consumers are suffering from a cognitive bias. The cognitive bias in this case is an inability to appreciate the time value of money. Consumers are unable to grasp that distant future cashflows get significantly discounted and their present values can be rather insignificant. Consumers only tend to see the absolute amount of net cash flow paid to the insurance company without taking into account the timing of those cash flows. It turns out, the simplest and most straightforward policy ie the 25 year premium paying term (S.No 1 in Table-1) actually is the cheapest option for consumers. This is inspite of it having the highest net cash outflow amongst all options (Table-3, S.No 1). This surprising conclusion is what we will discuss in the paragraphs ahead.

Discounting future cash flows : a method to evaluate policies:

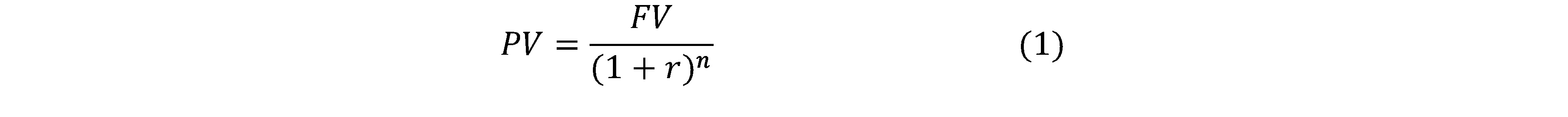

The idea behind discounting future cash flow is that a cash flow happening in the distant future is less valuable than a cash flow happening today and hence needs to be discounted at an appropriate rate to bring it to today’s value. The rate of discount applied is typically, the likely risk free fixed deposit rate or the perceived inflation rate over the period of interest. The formula for discounting a future cash flow to today is :

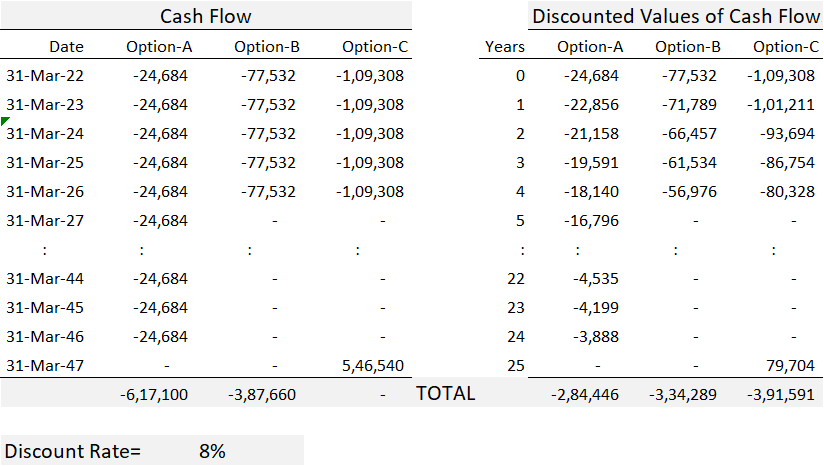

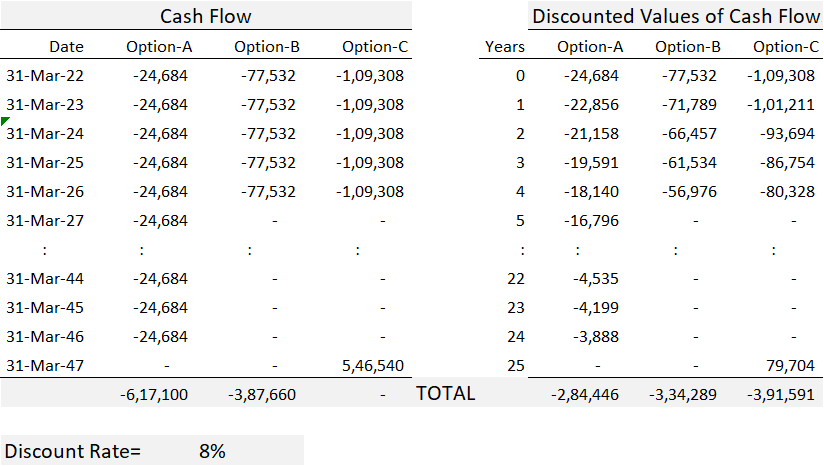

Where PV is the present value (or discounted value), FV is the future value, r is the discount rate and n is the number of years into the future the cash flow is happening. For simplicity sake let us assume that instead of monthly premium payouts, premiums are paid on an annual basis. Let us also multliply the monthly premiums by 12 to get the approximate annual premium payable on a policy. With data from Table-1 and Table-2, we will now construct two cash flow tables for three cases : Option-A: Simple 25 year premium paying term, Option-B : 5 year limited premium paying term and Option-C : 5 year limited paying term with return of premium. As an illustration we will do this for insurance company B. The two tables are presented below:

Table-5 : Raw Cash Flow Table-6 : Discounted Cash Flow

For clarity : cash flow values are negative when they are an outflow and they are positive if they are an inflow for the consumer. Table-5 is the raw value of all cash flows happening at various points in time. The values in Table-6 , are essentially the value of all future cash flows in Table-5, discounted at 8% to today (31-Mar-22) using the formula (1) presented above. For example Rs 24,684/- on 25-Mar-46 in Option-A of Table-5 is discounted to a present value of Rs 3,888/- as on 31-Mar-22 inTable-6. Another example would be Rs 5,46,540/-on 25-Mar-27 in Option-C on Table-5 gets discounted to Rs 79,704/- on Table-6. Clearly cash flows in the distant future get heavily discounted, while cash flows in the near future get discounted less. For example all the values in Table-5 as on 31-Mar-22 retain their value in Table-6 as they do not get discounted at all, since the cash flows are as of 31-Mar-22.The more the years n into the future a cash flow happens – the more it gets discounted.

At the bottom of Table-5 and Table-6 is the sum of all cash flows. The consumer would like to have the lowest cash outflow. An inspection of the bottom of Table-5 indicates that the raw cash out flow for Option-A is the highest (Rs 6,17,100/-) while the discounted cash outflow as shown in bottom of Table-6 for Option-A is the lowest (Rs, 2,84,446/-) – a complete reversal. In other words, the present value of all future cash flows indicate that Option-A – the simplest form of term life insurance is the preferred option for the consumer.

The main reason, for policy holders choosing return of premium policies, is the perception that they are not losing any money by getting their premiums back. Loss aversion bias is a cognitive bias that describes why, for individuals, the pain of losing is psychologically twice as powerful than the pleasure of gaining. Consumers are unable to grasp the fact that the return of premium happens in the distant future and its present value is significantly lower today.

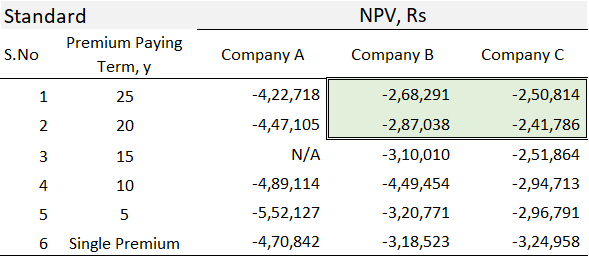

NPV and its relation to estimating cost of term life insurance:

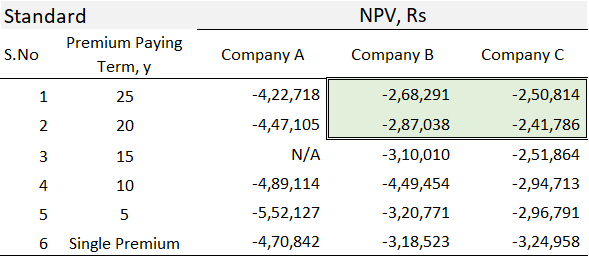

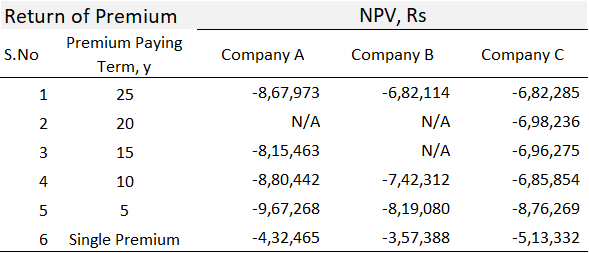

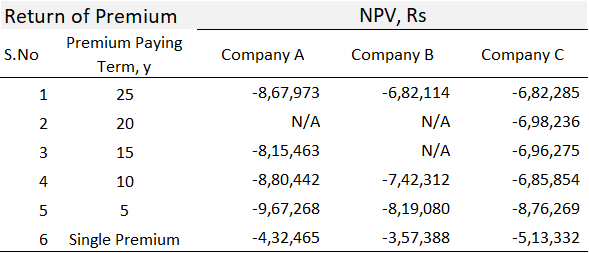

We have seen how discounting future cash flows provides a more realistic picture of the cost of a policy option. We argue that discounting all future cash flows to today’s value provide a firmer basis for comparison of policy options. We call the sum of all future discounted cash flows as Net Present value (NPV). NPV is used to take into account the various possibilities of limited premium paying terms and return of premium options. NPV thus becomes the most suitable yardstick by which to compare the cost of various policies. We therefore present below the NPV of all the premium paying options in Tables 7 and 8 below:

Table-7 : NPV for all standard term life insurance policies with limited premium paying term options

Table-8 : NPV for all return of premium term life insurance policies

In the tables above, the NPV represents the present values of all the future premiums and the return of premium cash back discounted to today at the rate of 8% - a reasonable assumption for long term FD rates/inflation. The negative numbers indicate a cash out flow from the consumer. This would mean, that lower negative NPV indicates a cheaper policy. Using NPV enables us to bring all policies to a common ground for comparing prices.

As mentioned earlier, NPV indicates the present value of cashflows discounted over a period of time, at a given rate. Essentially, the lower the NPV, the lesser amount of premiums the consumer is paying to the insurance company. Of the lowest four NPVs(highlighted in light green and boxed) in the above two tables, the 25 year regular premium paying term and the 20 year limited premium paying term options of insurance companies A and B are the lowest. The main reason behind having the lowest NPV is because the policy holder is paying the least per month premium out of all the premium paying term options. Another reason for having the lowest NPV is because the premiums are paid over a substantially longer period of time, Thus the premiums are subject to being discounted for a larger period of time, decreasing its NPV. On the other hand in return of premium policies, as shown in Table-5 and Table-6, the discounted value of the return of premium happening after 25 years at the end of the policy term does not reduce the cost much and as a result return of premium policies actually have a higher NPV. The NPV for return of premium policies are almost double than that of simple term insurance policies. This is because the premiums are almost 2 times that of a simple term insurance. The premiums received at the end of term are substantially less since, discounting works over a long period of time resulting in depreciation of real value of money. For example, in insurance company A return of premium plan, total premiums paid by policy holder for 25 year regular pay term, Rs5,067x 12X25 = Rs 15,20,100/-. NPV of those premiums when received at the end of the term is only Rs 8,67,973/-. Essentially, the policy holder is losing Rs 15,20,100/- - Rs 8,67,973/- = Rs 6,52,127/-.

There are a few other points to consider while choosing a term life policy including claim settlement ratios. We will update this blog at later point in time to discuss these matters further.

Term life insurance policy:

Term life insurance provides life insurance coverage for a specified term. Term life insurance lasts for a specific time period – this is called the term of the policy. The policy holder pays premiums (annually or monthly) to the insurance company during the term of the policy. If the insured has an untimely death, within the term of the policy, the nominees of the insured would receive a pay out of the insured amount. For example, A is aged 40 and takes a term life insurance worth Rs 1,00,00,000/- for a term of 25 years (ie upto to age 65). If A dies at age 61, his nominees, will receive a pay out of Rs 1,00,00,000. However, if A does not die during the term of the policy, his term life insurance would lapse at the end of the term (age 65) and no sum is due either to A or his nominees. Thus, if A survives the term of the policy, he stands to lose all his paid premiums. Term life insurance policies do not accumulate cash value. Premiums on term life insurance, are flat throughout the term of the policy is significantly less expensive than traditional life policies. However, the premiums increase based on the age of the life insured at the point of initiating the term life insurance policy.

Limited premium paying term life insurance policy:

The standard version of a term life policy is for the premiums to be paid annually or monthly for the entire term of the policy. However, with innovations from insurance companies, policy holders now have the option of choosing limited premium paying term life insurance policies. In such policies, the premium paying term is lower than the policy term. For example, A takes a term insurance policy for 25 years and opts for a the limited premium paying term of 15 years. A thus has to pay premiums only for the first 15 years of the policy and for the remaining 10 years, the term life policy is still in force (ie A continues to retain his life insurance cover for the entire 25 year term). In the table below, a 25 year term life policy is considered. For this policy, the monthly premiums charged by selected insurance companies is tabulated for different premium paying terms ie : (25 years, 20 years, 15 years, 10 years and , 5 years and single premium)

Table-1: Monthly premium for simple 25 year term policy with different paying terms

Source : Website of various insurance companies

S.No 1 in Table-1 is the regular premium paying term option in which the policy holder has to pay premiums for the entire 25 year term for which he is insured. For example, A takes a term life insurance from insurance company C, with a premium paying term of 25 years. A's monthly premium would then be Rs 1,923/- for the next 25 years. All the other options (S.No 2 to 6) are limited premium paying terms in which the policy holder can pay premiums for a period less than the 25 year term of the policy i.e either (20,15,10,5 or single premium) years. It may be noted that the limited premium paying term options have higher premiums than the regular premium paying term option. In-fact, the premium progressively increases as the premium paying term reduces and is maximum for the single premium option.

Return of premium term life insurance policy:

Insurance companies also offer term life insurance policies with an option of getting premiums back at the end of the term, in case the insured does not die. These type of term insurances are known as return of premium term life insurance policies. The premiums for such policies are drastically higher than premiums for regular term life insurance plans. In Table-2 below, premiums charged by various insurance companies for various term life insurance plans with return of premium option is presented . The premiums for simple term life insurances are substantially lesser than premiums paid for return of premium policies

Table-2:Monthly premiums for return of premium policies

Source : Website of various insurance companies

Comparing the various term life insurance options is very confusing for the lay investor. The subject of this article is to investigate these various term life insurance policies options and provide a methodology of how to choose the best option.

Comparing cost of policies with net premiums paid:

A simplistic approach to studying the various policy options is to consider the net premiums paid over the life time of the policy. Table-3 and Table-4 below calculate the net premium paid for standard term life insurance and return of premium options respectively.

Table-3: Net premium paid over the entire term of standard term life insurance policies

Table-4: Net premium over the entire term of return of premium term life insurance policies

Psychology behind choosing a policy option :

Consumers tend to consider the raw net cash out flow when comparing policies. For example an examination of Table-3 and Table-4 above indicate that the net cash out flow is highest for the standard term life insurance option (S.No 1 in Table-3), followed by the limited premium paying term life policies (S.No 2 to 6 in Table-3) and then followed by the lowest net cash outflow- being the return of premium policies (all Table-4 data points). In the return of premium term life policies, at the end of the policy term, the total paid premiums are returned and the net cash out flow from the policy holder is zero. The psychology behind consumers going for return of premium policies over simple term life insurance seems to be the security of the policy holder getting his/her premiums back. By getting all paid premiums back, it would seem to the consumer that he is effectively getting a Rs 1 cr term life policy for free (i.e net cash outflow is zero).

We set out to prove here in this article, that in selecting net cash out flow as a method to determine cheapness of a policy, consumers are suffering from a cognitive bias. The cognitive bias in this case is an inability to appreciate the time value of money. Consumers are unable to grasp that distant future cashflows get significantly discounted and their present values can be rather insignificant. Consumers only tend to see the absolute amount of net cash flow paid to the insurance company without taking into account the timing of those cash flows. It turns out, the simplest and most straightforward policy ie the 25 year premium paying term (S.No 1 in Table-1) actually is the cheapest option for consumers. This is inspite of it having the highest net cash outflow amongst all options (Table-3, S.No 1). This surprising conclusion is what we will discuss in the paragraphs ahead.

Discounting future cash flows : a method to evaluate policies:

The idea behind discounting future cash flow is that a cash flow happening in the distant future is less valuable than a cash flow happening today and hence needs to be discounted at an appropriate rate to bring it to today’s value. The rate of discount applied is typically, the likely risk free fixed deposit rate or the perceived inflation rate over the period of interest. The formula for discounting a future cash flow to today is :

Where PV is the present value (or discounted value), FV is the future value, r is the discount rate and n is the number of years into the future the cash flow is happening. For simplicity sake let us assume that instead of monthly premium payouts, premiums are paid on an annual basis. Let us also multliply the monthly premiums by 12 to get the approximate annual premium payable on a policy. With data from Table-1 and Table-2, we will now construct two cash flow tables for three cases : Option-A: Simple 25 year premium paying term, Option-B : 5 year limited premium paying term and Option-C : 5 year limited paying term with return of premium. As an illustration we will do this for insurance company B. The two tables are presented below:

Table-5 : Raw Cash Flow Table-6 : Discounted Cash Flow

For clarity : cash flow values are negative when they are an outflow and they are positive if they are an inflow for the consumer. Table-5 is the raw value of all cash flows happening at various points in time. The values in Table-6 , are essentially the value of all future cash flows in Table-5, discounted at 8% to today (31-Mar-22) using the formula (1) presented above. For example Rs 24,684/- on 25-Mar-46 in Option-A of Table-5 is discounted to a present value of Rs 3,888/- as on 31-Mar-22 inTable-6. Another example would be Rs 5,46,540/-on 25-Mar-27 in Option-C on Table-5 gets discounted to Rs 79,704/- on Table-6. Clearly cash flows in the distant future get heavily discounted, while cash flows in the near future get discounted less. For example all the values in Table-5 as on 31-Mar-22 retain their value in Table-6 as they do not get discounted at all, since the cash flows are as of 31-Mar-22.The more the years n into the future a cash flow happens – the more it gets discounted.

At the bottom of Table-5 and Table-6 is the sum of all cash flows. The consumer would like to have the lowest cash outflow. An inspection of the bottom of Table-5 indicates that the raw cash out flow for Option-A is the highest (Rs 6,17,100/-) while the discounted cash outflow as shown in bottom of Table-6 for Option-A is the lowest (Rs, 2,84,446/-) – a complete reversal. In other words, the present value of all future cash flows indicate that Option-A – the simplest form of term life insurance is the preferred option for the consumer.

The main reason, for policy holders choosing return of premium policies, is the perception that they are not losing any money by getting their premiums back. Loss aversion bias is a cognitive bias that describes why, for individuals, the pain of losing is psychologically twice as powerful than the pleasure of gaining. Consumers are unable to grasp the fact that the return of premium happens in the distant future and its present value is significantly lower today.

NPV and its relation to estimating cost of term life insurance:

We have seen how discounting future cash flows provides a more realistic picture of the cost of a policy option. We argue that discounting all future cash flows to today’s value provide a firmer basis for comparison of policy options. We call the sum of all future discounted cash flows as Net Present value (NPV). NPV is used to take into account the various possibilities of limited premium paying terms and return of premium options. NPV thus becomes the most suitable yardstick by which to compare the cost of various policies. We therefore present below the NPV of all the premium paying options in Tables 7 and 8 below:

Table-7 : NPV for all standard term life insurance policies with limited premium paying term options

Table-8 : NPV for all return of premium term life insurance policies

In the tables above, the NPV represents the present values of all the future premiums and the return of premium cash back discounted to today at the rate of 8% - a reasonable assumption for long term FD rates/inflation. The negative numbers indicate a cash out flow from the consumer. This would mean, that lower negative NPV indicates a cheaper policy. Using NPV enables us to bring all policies to a common ground for comparing prices.

As mentioned earlier, NPV indicates the present value of cashflows discounted over a period of time, at a given rate. Essentially, the lower the NPV, the lesser amount of premiums the consumer is paying to the insurance company. Of the lowest four NPVs(highlighted in light green and boxed) in the above two tables, the 25 year regular premium paying term and the 20 year limited premium paying term options of insurance companies A and B are the lowest. The main reason behind having the lowest NPV is because the policy holder is paying the least per month premium out of all the premium paying term options. Another reason for having the lowest NPV is because the premiums are paid over a substantially longer period of time, Thus the premiums are subject to being discounted for a larger period of time, decreasing its NPV. On the other hand in return of premium policies, as shown in Table-5 and Table-6, the discounted value of the return of premium happening after 25 years at the end of the policy term does not reduce the cost much and as a result return of premium policies actually have a higher NPV. The NPV for return of premium policies are almost double than that of simple term insurance policies. This is because the premiums are almost 2 times that of a simple term insurance. The premiums received at the end of term are substantially less since, discounting works over a long period of time resulting in depreciation of real value of money. For example, in insurance company A return of premium plan, total premiums paid by policy holder for 25 year regular pay term, Rs5,067x 12X25 = Rs 15,20,100/-. NPV of those premiums when received at the end of the term is only Rs 8,67,973/-. Essentially, the policy holder is losing Rs 15,20,100/- - Rs 8,67,973/- = Rs 6,52,127/-.

There are a few other points to consider while choosing a term life policy including claim settlement ratios. We will update this blog at later point in time to discuss these matters further.