When I receive enquiries on the viability of Portfolio Managed Services (PMS), amongst the many pointers that I put out to prospective investors is to draw attention to the concept of High Watermarking and to ensure their PMS fund manager uses it to calculate performance fee. In the home page of our website under the “WHY AROHA” caption, under “Portfolio creation” we have said “Fees only after High Watermarking”. Due to the paucity of space on the home page, I felt it best that I use a blog to clarify the concept of High Watermarking and bring awareness to the public at large on this point.

What then is High Watermarking? And why should it be a feature that investors must insist upon before engaging any investment manager who charges for performance? The CFA Institute puts it well by saying – “high-water mark is the highest level of the fund on which performance fees were paid in the past”. It is a simple idea, and when put into practice ensures investment managers must rigorously outperform their benchmarks on a long term basis to generate performance fees. Lets see how this works in practice by working out an example.

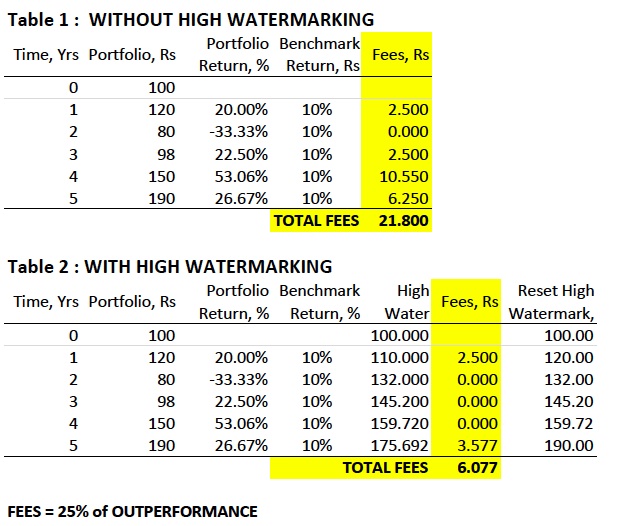

In the above example it is assumed that the portfolio manager will be paid a 25% performance fee for generating any return above the benchmark return (in this case 10%). The two tables above show how although the portfolio performance and the benchmark return are exactly the same for both - with and without High Watermarking, the performance fee paid to the manager can be drastically different between the two cases. Let us examine this in greater detail by going through a year by year analysis.

At time 0, the portfolio starts with 100 Rs, and within one year grows to 120 Rs. As the portfolio return is above the benchmark return of 10%, the fee payable is 0.25 X (120 – 110) = 2.5 Rs. – this is the same for both Table 1 and Table 2. i.e. no difference in fee exists whether High Watermarking is adopted or not.

In year 2, the portfolio decreases from 120 Rs to 80 Rs, which is a -33.33% return and it being lower than the benchmark return of 10% no fee is payable and this is the same for both Table 1 and Table 2. i.e. again no difference in fee exists whether High Watermarking is adopted or not.

Year 3 is interesting. The portfolio jumps from 80 Rs to 98 Rs (still lower than the original 100 Rs) yielding a portfolio return in year 3 of 22.5%. In Table 1 without High Watermarking, a fee is applicable since the portfolio has increased more than 10%. The fee payable in Table 1 works out to be 0.25 X (98 – 88) = 2.50 Rs. However in Table 2, no fee is payable. Why is that? The reason is that since the principle of High Watermarking has been adopted, the portfolio has not crossed the High Watermark for year 3 which is shown to be 145.20 Rs. The next question then is how is the High Watermark 145.20 Rs arrived at ?

For this, lets go through Table 2 again from year 0 onwards. Watch the three columns named “Portfolio”, “High Watermark” and “Reset High Watermark”. In year 0 all the three are equal at 100 Rs. In year 1, the portfolio rises to 120 Rs and the High Water Mark rises to 110 Rs (i.e. 1.10 X 100 Rs, i.e. 10% rise in benchmark) and since a fee of 2.50 Rs is paid, the High Water Mark is reset to 120 Rs (see “Reset High Water Mark for year 1). In other words, for the next year, the benchmark rate of 10% applies to 120 Rs and not to 110 Rs. i.e. “the highest level of the fund on which performance fees were paid”.

In year 2 the portfolio drops to 80 Rs, the High Watermark rises to 132 Rs (i.e. 120 Rs X 1.10) and since the portfolio is lower than the High Watermark no fees is payable and hence there is no reset in the High Watermark.

In year 3 the portfolio rises to 98 Rs and the High Watermark rises to 145.20 Rs (i.e. 132 Rs X 1.10). Since the portfolio is lower than the High Watermark, again no fees is payable unlike Table 1 where a fees is paid because the portfolio has risen by more than 10% over the previous year’s portfolio. In other words when No High Watermarking is employed, you are likely to pay the Investment Manager even when you are not making any real return. As is the case here. –i.e. you put in 100 Rs, 3 years ago and now in year 3 the portfolio is at 98 Rs – below your original investment corpus and you are still paying a performance fee of 2.5 Rs. Your portfolio has gone nowhere bt still you are paying a performance fee. It is like you are paying the Investment Manager just for recouping losses that he incurred on your portfolio in the first place !!

You can see that the principal of High Watermarking avoids such pitfalls. Infact It is only in year 5 when the portfolio (190 Rs) jumps above the High Watermark (175.69 Rs) does a fee become payable. The total performance fees paid, works out to 21.80 Rs without High Watermarking and just 6.07 Rs with High Watermarking. Of course this is just one example – nevertheless the investor is well advised to insist upon High Watermarking whenever Performance Fee is involved. It is my judgment that when High Watermarking is not adopted, REAL portfolio performance stands on a slippery slope that can only go downhill. No wonder Buffett in his recent annual letter to Berkshire-Hathaway shareholders has assailed money managers on wasting more 100 billion US$ of investor money on fees.

So on our home page when we see say “Fees only after High Watermarking”, we mean that there is NO fixed fee AND that we charge ONLY for performance above a suitable benchmark following a High Watermarking standard. This ensures that we are paid ONLY for genuinely beating benchmark returns that investors could otherwise have achieved by investing in simple low cost benchmark funds or bonds that are easily available in the market.