Unit Linked Investment Plan (ULIP) products have been marketed by insurance companies with great success. The tax benefits under section 80C to premium paid for ULIPs has been a significant pull aspect of the product. A ULIP many a time is essentially a mutual fund product being masked under the pretention of being an insurance product simply to claim tax benefits. The investor is perpetually confused and many a time simply sees the tax benefits that she accrues as a result of the investment and gives very little thought to how expensive these products really are.

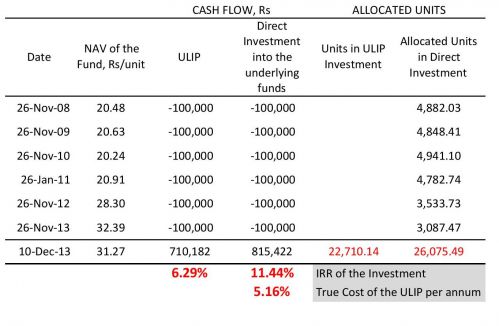

The critical element of confusion here is the way a ULIP operates. On the surface if one were to look at Net Asset Values (NAV) of any random ULIP fund, it would seem that it has performed reasonably well against its benchmark; however the true story lies elsewhere. What happens in a ULIP is that when a premium is paid, units are allocated to the investor based upon the prevailing NAV of the fund. The NAV is quoted in INR/unit. As a result, units are credited to the investor’s account by dividing the premium paid by the NAV of the fund. Subsequent to this, all the charges – whether it be 'allocation charges', 'admin charges', 'mortality charges', and 'service tax' are all charged to the client by debiting units allocated to the investor. In this process the NAV of the fund remains unaffected and the net number of units allocated to the investor reduces. This is illustrated in the table below:

In the above hypothetical table we compare how an investor’s premiums would be invested if it were invested in a ULIP vs if it were DIRECTLY invested in the underlying fund. It is seen that the investor pays one lakh premium every year. Finally after paying six premiums, it is seen that the number of units allocated if the investor were directly investing in the underlying fund would be 26,075.49 units versus 22,710.14 units if invested through the ULIP. Where did all the missing units go? They have gone into the agent’s pocket (allocation charges), insurance company’s pocket (allocation charges and admin charges), mortality charges (to give you life cover and is probably the only value add from this product) and the Government of India’s pocket (service tax charges).

The table above shows that the NAV of the fund has grown at an IRR of 11.44% but the investor’s funds have grown at a paltry 6.29%. That leaves a gap of 5.16% per annum. In other words, while the underlying fund has grown at an IRR of 11.44% per annum, the real funds of the investor have grown only at 6.29%. The difference in the two would amount to the cost of the ULIP which in this case works out to be 5.16% per annum!! Sure a portion of these charges are to insure one’s life – but it is well known that a 40 year old man can get a term cover of INR one cr for about INR 20,000 per annum which works out to be 0.2% or about 1/25th the cost of the 5.16% shown above!!

The Government of India has done a great disservice to the mutual fund industry by not extending the tax benefits that ULIPs enjoy under section 80C. In the process, the lay indian investor has been pushed away from simple and cheap mutual fund products and pulled towards complicated and expensive ULIPs. Do note that the table above is a hypothetical case. The investor will need to do due diligence for the specific ULIP she has or intends to purchase.