The month of April is busy for Aroha Capital. It is the month of the year when client invoices are raised and clients cut their cheques to us. With growth in our client base and the quantum of our outperformance becoming non-trivial, we have had the pleasure of discussing with many of our clients our fees structure and the pros and cons that come with it. This is going to be a rather long blog so do bear with us. Amongst the few pertinent questions we were asked by clients were the following:

Client question 1 : Aroha Capital keeps mentioning that client portfolios are relatively protected against future underperformance to the extent of the un-invoiced fees in clients’ portfolios. Can you please explain this is greater detail?

Client question 2 : Can you please explain how much of the net asset value of my portfolio actually belongs to me and if I were to stop my engagement with Aroha Capital today what will happen?

Client question 3 : Every year Aroha Capital gives us an invoice and the High Watermark is re-calculated. Can you please explain the calculation of the High Watermark and how it changes after an invoice is raised?

Client question 4 : Aroha Capital says they have a skin in the game philosophy. This is a term I do not understand. Can you explain how this is actually conducted in practice?

The above questions asked by our clients have in-fact, already been clarified with each of them individually during sign-up. Nevertheless it is but natural that questions crop up during an actual invoicing exercise. Further more when fees starts growing as result of continued outperformance against benchmarks, clients have every right to know how it is that the invoiced amounts are calculated and what is their actual current portfolio status. Instead of answering each of the questions above piece meal, we will take the opportunity of this blog to make an exhaustive example of the various scenarios that can play out.

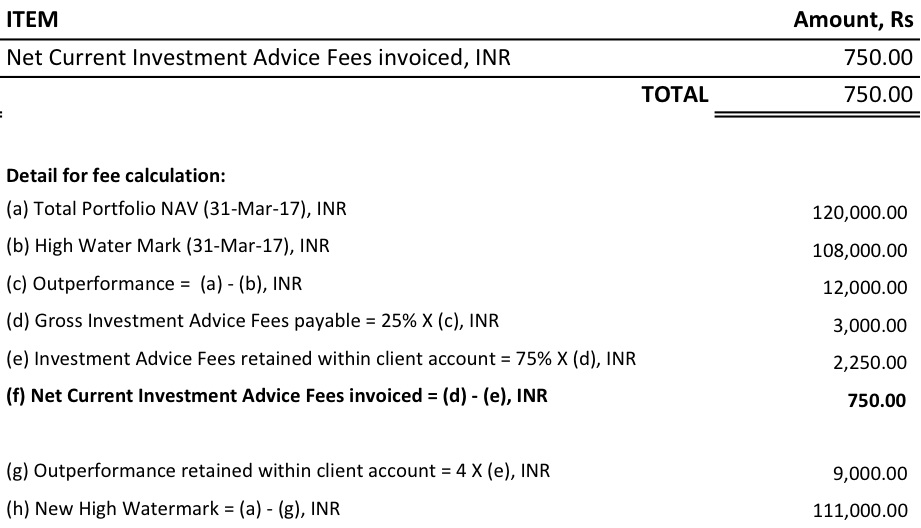

A typical invoice presented to clients looks like this:

Pay only for performance : Let us assume that the invoice above is generated on 31-Mar-17. Under the detail for fee calculation, the first item (a) is the Net Asset Value of the portfolio as on 31-Mar-17. It is the aggregate value of all investments held in the client’s portfolio. Item (b) is the High Watermark on 31-Mar-17. The High Watermark is calculated based on the underlying Benchmark. The Outperformance (c) is the difference between the Net Asset Value (a) and the High Watermark (b). The Outperformance (c) must be positive for a fee to be payable. If the Outperformance (c) is negative it means Aroha Capital has been unable to manage the client’s portfolio better than the underlying benchmark and as a result does not deserve to be paid a fee. This espouses the principle of paying only for performance.

Calculation of the New High Watermark : With the first principal of paying only for performance laid out, let us proceed to describe the next few line items of the invoice. In the above invoice the Outperformance (c) is calculated to be Rs 12,000/-. Aroha Capital is eligible to bill the client 25% of any outperformance generated, which in this case works out be 25% of Rs 12,000/- = Rs 3,000/-. In other words if the client or Aroha Capital were to terminate the investment advise agreement on 31-Mar-17, a fees of Rs 3,000/- will have to be paid by the client and the investment advise agreement will be terminated. This is called the Gross Investment Advice Fee payable (d). However if the agreement is not terminated, Aroha Capital invoices only 25% of (d). Called the Net Current Investment Advise Fees Invoiced (f), this amounts to 25% of Rs 3,000/- = Rs 750/-. In other words (e) which is Rs 2,250/- of fees rightly belonging to Aroha Capital is retained within the client’s account.

How is this (e) i.e Rs 2,250/- accounted for? Rs 2,250/- or (e) reflects an outperformance of 4 X (e) ie 4 X Rs 2,250/- = Rs 9,000/- of Outperformance not yet charged out (g). As a result the New High Watermark (h) is calculated to be Total Portfolio NAV i.e (a) – Outperformance not yet charged out (g) = Rs 1,20,000/- - Rs 9,000/- = Rs.1,11,000/-. This sounds a little confusing.

Think about it like this. Lets say the client were to pay Rs 750/- i.e (e) with the intention of continuing the engagement, but then after paying this Rs 750/- were the very next instant decide that no he would like to stop the engagement. In this scenario, the Portfolio Value (a) continues to Rs 1,20,000/- and the New High Watermark (g) being Rs 1,11,000/- will mean that an Outperformance of Rs 9,000/- exists and 25% of it is Rs 2,250 which the client will pay and exit the arrangement. It is through the recalculation of the New High Water Mark (h) that the retained fee is reflected. This section hopefully answers Client Question 3.

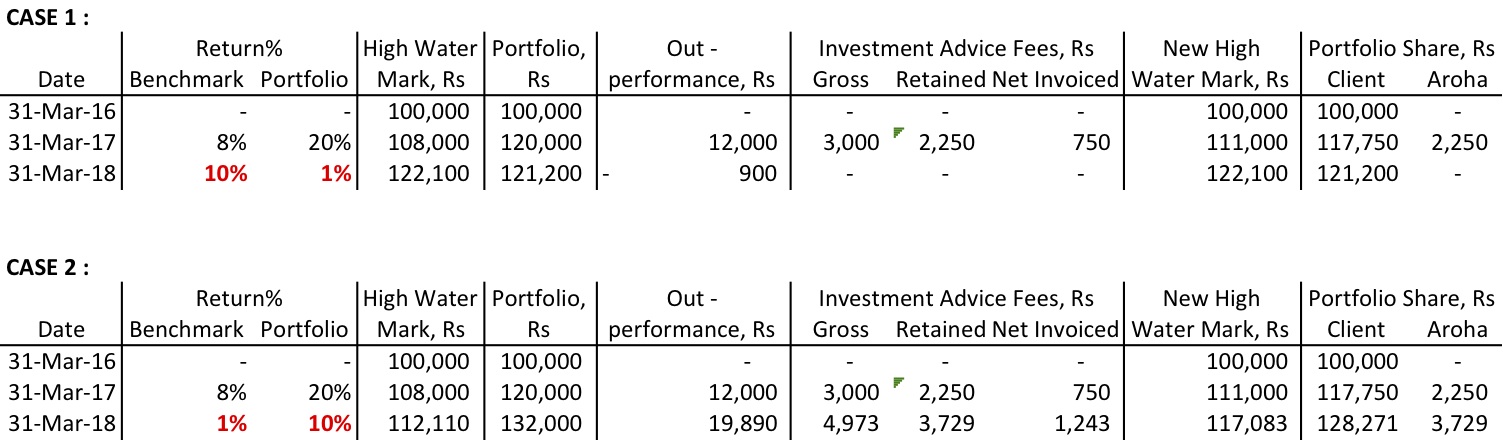

Our skin in clients' portfolios : How does this retention of fee help the client? How is Aroha claiming that client portfolios are cushioned to the extent of the retained fee? To answer this let us start from the above invoice and present two cases:

Case 1 above assumes in the next year (31-Mar-18) the benchmark generates a return of 10%, and the portfolio generates only 1% return. The portfolio has moved from a situation of having Rs 12,000/- of Outperformance one year ago to now having Rs 900/- of Under-performance!! As there is no positive Outperformance now, the Gross Investment Advice Fees is Rs 0/- and Aroha has lost all of its retained fees of Rs 2,250/-.

In other words, not only is Aroha denied of fees but also it’s portion of the portfolio has moved from Rs 2,250/- to Rs 0/- which is a 100% reduction. On the other hand, you will note that the client’s portion has moved from Rs 1,17,750/- to Rs 1,21,200/- a gain of 2.93%, which is better than the performance of the overall portfolio (1.00%). This has essentially happened at the expense of Aroha’s retained fee within the client’s portfolio, which has been wiped out. You can see how we get pinched (not trivially) if we under-perform. Not only is our fee at risk, but the risk to our fee is significantly higher than the risk to the client’s portfolio.

Of-course on the flip side let us say the situation were in-fact reverse and the benchmark generated only 1% return while the portfolio generated a 10% return. This is Case 2 above. In this case Aroha has massively outperformed. Aroha’s fees goes up to Rs 1,243/- a 65.73% increase and Aroha’s portion of the portfolio has moved from Rs 2,250/- to Rs 3,729/- again a 65.73% jump from the previous year. The client’s portfolio increases to Rs 1,28,271 from Rs 1,17,750/- an 8.93% increase - well ahead of the benchmark return of 1% but of-course lower than the overall portfolio return of 10% due to the fees.

This working clearly shows that Aroha Capital’s fees is an amplified version of the outperformance outcomes in client portfolios. We get richly rewarded if we do well (continued outperformance) over the long term and we likewise get severely penalized if we underperform. We do not have only the upside. We take a beating on the downside too. This is how we implement our skin in the game philosophy and this is our answer to both questions (1) and (4) above.

Reading portfolio statements: To clarify the situation further, starting this month, we will present portfolio reports with greater clarity by reporting: 1) Net Asset Value of Portfolio 2) Client share of the portfolio and 3) Aroha notional share of the portfolio. That way the client clearly understands if she were to discontinue Aroha’s services how much exactly will be the value of her portion of the portfolio.

If you have managed to reach till this point in the blog, my deepest gratitude for having the patience of trying to understand what Aroha is trying to do. This Iong blog however was necessary to clarify the invoicing procedure at Aroha and the practical implementation of the Skin in the Game philosophy in Investment Advice that is the corner-stone of what Aroha is trying to do.