Amidst the COVID-19 crisis the world finds itself in, and the commensurate rout that the markets have witnessed, we report on our annual performance for one more year. Whilst each client has her own individual portfolio holding report and the corresponding high water mark to hold it’s performance against, it makes sense for Aroha to take stock of its performance (post fees) on a composite level. The composite portfolio is the sum total of all the client portfolios and the composite high water mark is calculated by weighting each client’s individual high water mark by the client’s portfolio as a percentage of Aroha’s total portfolio. The performance being reported in this annual report is a time weighted return (CAGR) as against the cash weighted XIRR being reported in each of your individual portfolios. There is a distinction between the two – the subject of which I intend to write a blog upon, hopefully in the months ahead.

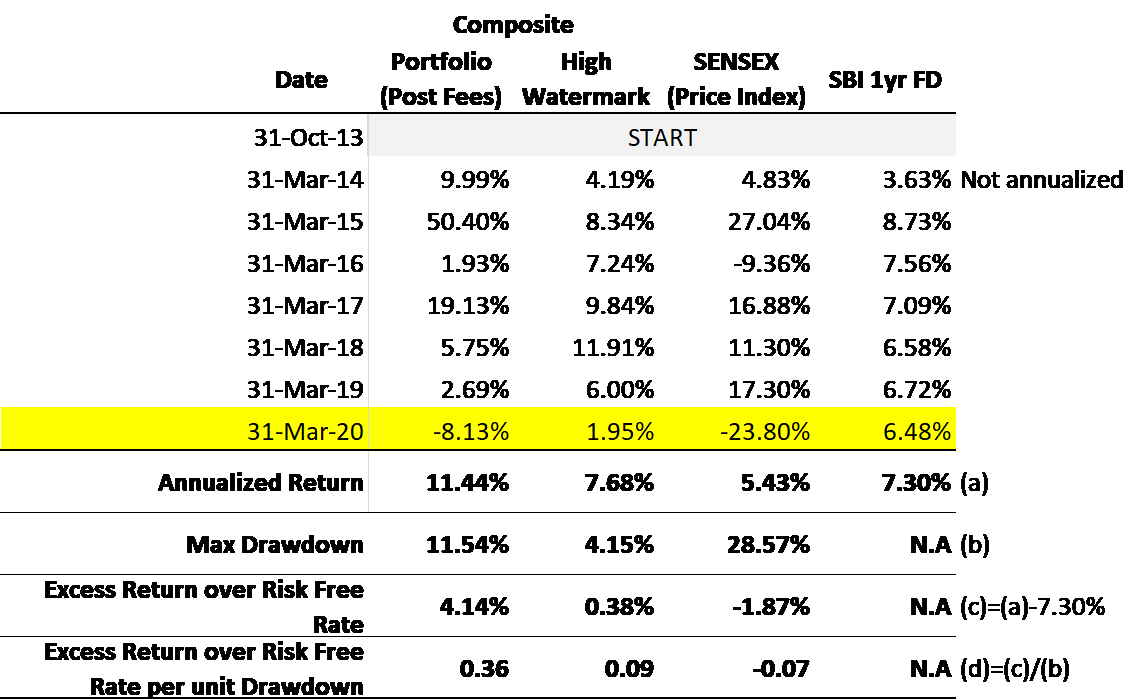

Aroha’s performance on a composite level is reported in the table below :

We finish the financial year with another dismal performance against our high water marks. At a composite level, portfolios have generated a negative -8.13% versus a composite high water mark which generated a positive 1.95%. This has us underperforming the composite high water marks for the third straight year in succession. In-fact over the last six full years (excluding 31-Mar-14 numbers) of performance record, we have beaten the high water mark only in two of those years and four of the remaining years have been underperformance. If we consider our performance on an annualized basis since inception, we continue to outperform our high water marks at a composite level i.e 11.44% annualized portfolio return vs 7.68% annualized high water mark return. This is because in the two years we have out performed the high water mark, the out performance has been very high. In other words, we seem to be performing rather erratically against our high water marks.

The markets are in the midst of the COVID-19 crisis and are in significant drawdowns currently. In this light it makes sense to understand how much extra return the composite portfolio is generating above the risk free rate (given in row marked as (c) in the table above). Further how much risk is being undertaken to generate this extra return (given in the row marked as (b) in the table above). In estimating risk, we are using maximum drawdown as the proxy. When we divide the number in row (c) by row (b), we are trying to estimate how much extra return is being generated above the risk free rate per unit of drawdown. This number for the composite portfolio is 0.36 vs 0.09 for the High Water Mark – indicating that the composite portfolio is not only generating excess return but is also generating this extra return at a rate of about 4x (0.36 vs 0.09) that of the high water mark for a given level of drawdown. In other words the risk adjusted return for the composite portfolio is significantly better than the high water mark.

In these times of extreme draw downs, portfolio performance is critical. Robustness of portfolios at these times are a key determinant of how rapidly they can bounce back when things come back to normalcy. We can say with pride that our portfolios have stayed relatively robust in these times of crisis and are well positioned for a significant rebound when things return to normalcy. Many of our portfolios have fat cash positions which have provided the necessary buffers. This brings us to what we want to focus on – i.e what are our thoughts on the ensuing crisis and how should we respond. The Government of India has responded to the COVID-19 crisis with a heavy handed lock-down bringing economic activity to a virtual halt. We are no experts on what needs to be done to arrest the COVID-19 spread – however we wonder whether the economic pain that will ensue as a result of this lock down will be justified. A myriad of other risks are bound to prop up.

First and foremost if the lock-down is extended for too long a period, with the masses bearing the brunt of the lock down, there could be large scale protests and a democratically elected Government will be forced to open up economic activity again in-spite of the COVID-19 risks persisting – we cannot see a lock down persisting beyond 45 days – it is just too high a cost for a country such as ours to bear. Companies with flimsy/marginal business models may not have the necessary buffers to stand ground. So it makes eminent sense to allocate incremental risk capital only to the best of companies with massive buffers around their business models. Not only will these companies survive, they will also be in a significantly stronger position to gain market share when things return to normalcy. Although the duration of the lock down in our mind is going to be around a month, the duration of the crisis remains uncertain and markets are probably going to oscillate wildly trying to come to terms with the uncertainty that is pervading – it thus is probably safer to allocate incremental risk capital over the next 3 months or so in steady daily/weekly drips.

We have committed a large portion of our safe capital to liquid funds. In times such as these it seems even AAA Commercial Paper and Commercial Deposits both of which form the bulk of liquid fund investments, may come under redemption pressure and there could be some mark to market losses experienced in these funds in the short term. We are debating whether it is wiser to re-allocate liquid fund capital to overnight funds which brings down the risk a further notch. We will be reaching out to each of you to debate this through. The downside of this re-allocation is that those liquid funds invested for less than 3 years, will incur a Short Term Capital Gain on redemption – which is taxable at the marginal rate of tax.

Our portfolios have been relatively buffered during this drawdown. In low risk portfolios, the large cash positions have buffered the drop, while even in high risk portfolios, our basket of risky ideas have dropped relatively less than the market at large. We nevertheless could have done a better job here – especially in stock selection. We remain convinced that economic activity is bound to come back. There remains NO OTHER OPTION for a young country such as ours. If you as an investor also believe so – then there is no better time to invest incremental risky capital in companies with sound business models in a steady drip over the next three months. Thank you for one more year of trust.

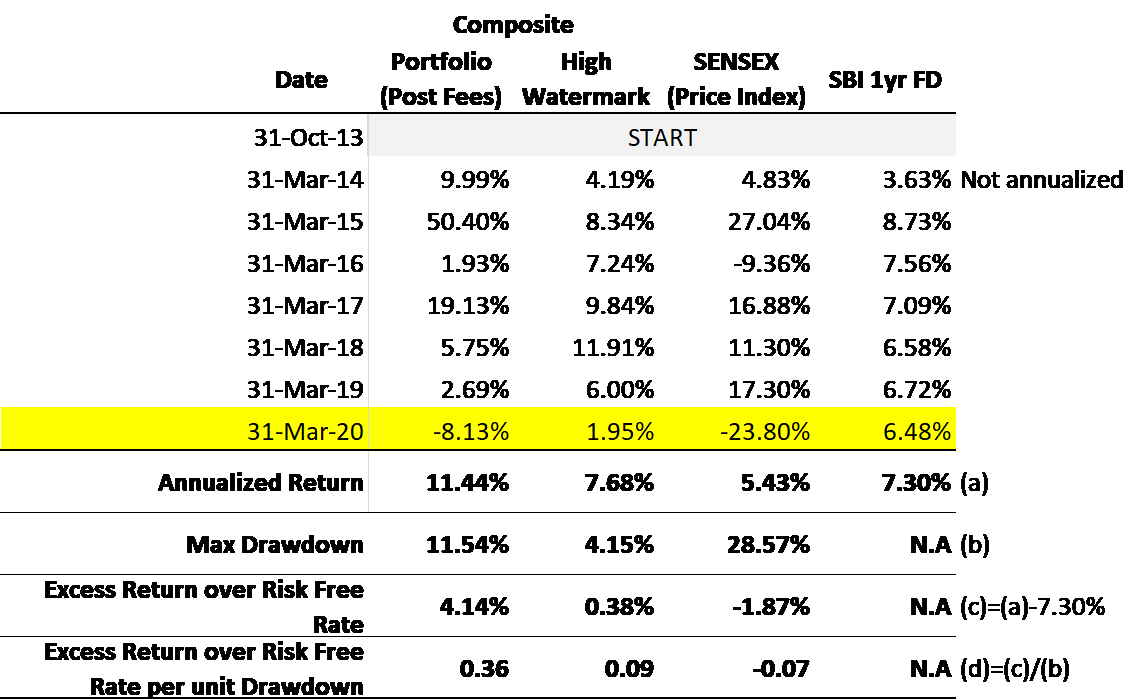

Aroha’s performance on a composite level is reported in the table below :

We finish the financial year with another dismal performance against our high water marks. At a composite level, portfolios have generated a negative -8.13% versus a composite high water mark which generated a positive 1.95%. This has us underperforming the composite high water marks for the third straight year in succession. In-fact over the last six full years (excluding 31-Mar-14 numbers) of performance record, we have beaten the high water mark only in two of those years and four of the remaining years have been underperformance. If we consider our performance on an annualized basis since inception, we continue to outperform our high water marks at a composite level i.e 11.44% annualized portfolio return vs 7.68% annualized high water mark return. This is because in the two years we have out performed the high water mark, the out performance has been very high. In other words, we seem to be performing rather erratically against our high water marks.

The markets are in the midst of the COVID-19 crisis and are in significant drawdowns currently. In this light it makes sense to understand how much extra return the composite portfolio is generating above the risk free rate (given in row marked as (c) in the table above). Further how much risk is being undertaken to generate this extra return (given in the row marked as (b) in the table above). In estimating risk, we are using maximum drawdown as the proxy. When we divide the number in row (c) by row (b), we are trying to estimate how much extra return is being generated above the risk free rate per unit of drawdown. This number for the composite portfolio is 0.36 vs 0.09 for the High Water Mark – indicating that the composite portfolio is not only generating excess return but is also generating this extra return at a rate of about 4x (0.36 vs 0.09) that of the high water mark for a given level of drawdown. In other words the risk adjusted return for the composite portfolio is significantly better than the high water mark.

In these times of extreme draw downs, portfolio performance is critical. Robustness of portfolios at these times are a key determinant of how rapidly they can bounce back when things come back to normalcy. We can say with pride that our portfolios have stayed relatively robust in these times of crisis and are well positioned for a significant rebound when things return to normalcy. Many of our portfolios have fat cash positions which have provided the necessary buffers. This brings us to what we want to focus on – i.e what are our thoughts on the ensuing crisis and how should we respond. The Government of India has responded to the COVID-19 crisis with a heavy handed lock-down bringing economic activity to a virtual halt. We are no experts on what needs to be done to arrest the COVID-19 spread – however we wonder whether the economic pain that will ensue as a result of this lock down will be justified. A myriad of other risks are bound to prop up.

First and foremost if the lock-down is extended for too long a period, with the masses bearing the brunt of the lock down, there could be large scale protests and a democratically elected Government will be forced to open up economic activity again in-spite of the COVID-19 risks persisting – we cannot see a lock down persisting beyond 45 days – it is just too high a cost for a country such as ours to bear. Companies with flimsy/marginal business models may not have the necessary buffers to stand ground. So it makes eminent sense to allocate incremental risk capital only to the best of companies with massive buffers around their business models. Not only will these companies survive, they will also be in a significantly stronger position to gain market share when things return to normalcy. Although the duration of the lock down in our mind is going to be around a month, the duration of the crisis remains uncertain and markets are probably going to oscillate wildly trying to come to terms with the uncertainty that is pervading – it thus is probably safer to allocate incremental risk capital over the next 3 months or so in steady daily/weekly drips.

We have committed a large portion of our safe capital to liquid funds. In times such as these it seems even AAA Commercial Paper and Commercial Deposits both of which form the bulk of liquid fund investments, may come under redemption pressure and there could be some mark to market losses experienced in these funds in the short term. We are debating whether it is wiser to re-allocate liquid fund capital to overnight funds which brings down the risk a further notch. We will be reaching out to each of you to debate this through. The downside of this re-allocation is that those liquid funds invested for less than 3 years, will incur a Short Term Capital Gain on redemption – which is taxable at the marginal rate of tax.

Our portfolios have been relatively buffered during this drawdown. In low risk portfolios, the large cash positions have buffered the drop, while even in high risk portfolios, our basket of risky ideas have dropped relatively less than the market at large. We nevertheless could have done a better job here – especially in stock selection. We remain convinced that economic activity is bound to come back. There remains NO OTHER OPTION for a young country such as ours. If you as an investor also believe so – then there is no better time to invest incremental risky capital in companies with sound business models in a steady drip over the next three months. Thank you for one more year of trust.