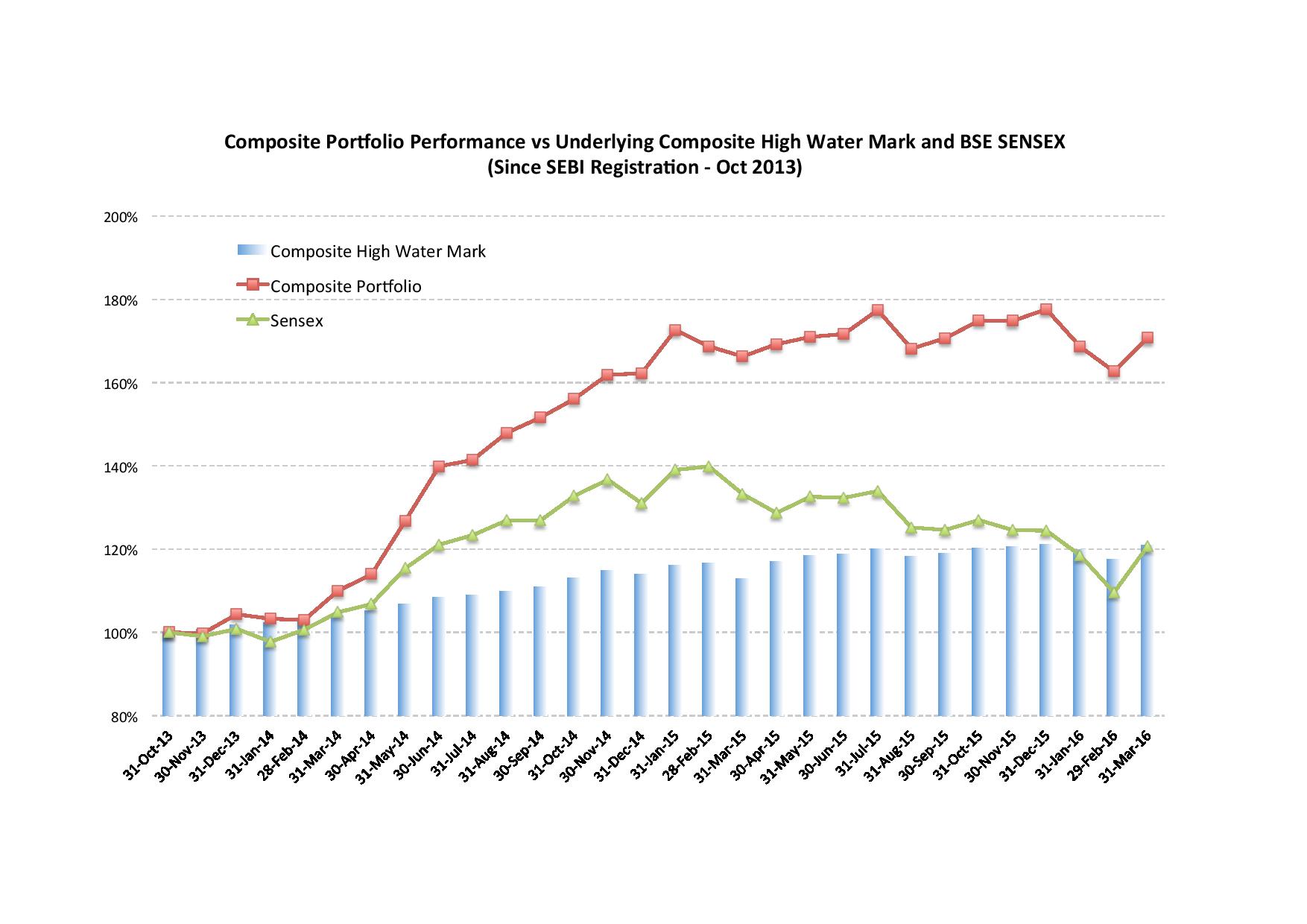

In my blog of 31-Mar-15, I promised to bring to you a report card on the performance of Aroha Capital one year from then. One year has passed and it is time to take stock of our performance. As discussed in my then blog, Aroha Capital provides investment advice across the spectrum of investor risk tolerance and hence, a composite highwater mark of all our clients would be a fair representation of an appropriate benchmark against which our performance should be judged. Nevertheless the BSE SENSEX is also represented just to provide a known benchmark and to bring some context to the graph presented below.

As given in the legend to the graph, the blue bars are the composite high water marks, the green line is the SENSEX, and the the red line is the composite portfolio. On March 31, 2015, the composite highwater mark was at 113%, the SENSEX was at 133% and the composite portfolio was at 166%. Today, March 31, 2016, the three are at values 121%, 121% and 171% respectively. All these numbers are relative to October 31, 2013, when Aroha Capital started operations under the SEBI Registered Investment Adviser license. The increase in the composite highwater mark from 113% to 121% is a reflection of the fact that many of our investors are risk averse and hence their benchmarks are the more risk averse CPI rate of inflation + 2% (~7.5% during the year) or the SBI one-year FD rate (~7.5% during the year). Against this the composite portfolio managed by Aroha Capital has increased from 166% to 171%. In other words Aroha Capital's composite portfolio has marginally underperformed its composite benchmark but has convincingly outperformed the BSE SENSEX, which has infact dropped from 133% to 121% in the same period.

As is normally the case, the devil is in the details. The fact of the matter is that Aroha Capital has underperformed in its low-risk benchmark portfolios (for this year) while it has significantly outperformed in its high-risk benchmark portfolios. It must be mentioned that inspite of underperforming in the low-risk benchmark portfolios in the last one year, thanks to the concept of a 'retained fee at risk' within client portfolios, clients continue to beat their respective chosen benchmarks (from initiation) because it is Aroha Capital's retained fee that has actually been partly eaten into, thus significantly protecting the client even in a down year such as this where the BSE SENSEX has dropped by ~9%.

A perusal of my last years blog will show that last year, low-risk benchmark portfolios had significantly outperformed precisely because the equity portion within these portfolios had risen considerably faster than the benchmarks resulting in outsized returns. I had warned that these outsized returns are unlikely to continue and brought in the idea of curtailing our invoiced fee at 25% of the payable fee and not just retaining 75% of the fee in client portfolios, but also keeping this retained fee 'at risk' - in other words, this fees was not guaranteed at a later point in time and was actually 'at risk' based on the outcomes in the years that follow. Well this is actually exactly what has panned out this year - and our retained fee has significantly dropped in these low-risk benchmark portfolios. However what excites me for the years ahead is that just as the equity portion has underperformed this year, it is bound to bounce back in the years ahead giving a major flip to these very same low-risk portfolios, thus providing a significant fees to us. In other words, I am betting on the fact that the equity portion (mostly index based ETFs or Mutual Funds) is bound to beat inflation or the SBI one-year FD rate considerably over a period of time. You can see that our incentives are 100% aligned with yours.

Do note that for low-risk benchmark portfolios, we have provided 4 levels of prudence. The first is at the level of % allocation to equity i.e curtailing allocation in accordance with investor risk appetite. The second is by largely taking low-cost index exposure and very low if not absent specific stock risk. The third is by staggering our entry into equity and not making large lump-sum investments. And the fourth, as already discussed, is to invoice only 25% of the fees payable while maintaining the retained 75% of fee 'at risk'. I am proud to say that this prudence has helped our investors ride out safely through the storm that has engulfed our equity markets in the last one year. Our low risk benchmark client portfolios are safe, well-insulated and poised for significant take off when the overall markets begin to turn.

Let us turn our attention to the high-risk benchmark portfolios. These portfolios have significantly outperformed the benchmarks (SENSEX and Small Cap Index) this year. The outperformance has ranged from ~+4% to +14%. Again as prudential measure, we stay in a significant level of cash ~25% and have invoiced only 25% of our fees retaining 75% of our fee 'at risk' in client portfolios. Our portfolio companies in the high-risk benchmark portfolios have been subject to wild swings in their prices, giving rise to opportunity both for buying and selling. Selling however has been muted as we have been very reluctant to expose our clients to short-term capital gains taxes. Interestingly our estimated maximum churn rates seem to be south of 20% and many of you would actually have experienced zero churn. As we continually search the landscape for attractively priced securities, it is likely that in sudden market upswings we may significantly underperform given the relatively large cash positions we maintain. The true test of performance as always is time and we are too young a company to lay any claim to superior stock picking skills.

On a parting note, we thank you – our clients, without whom none of what I have described above would have been possible. We seek your continued patronage and hope we can continue to live up to the responsibility you have entrusted us with.