Savers in the USA have the option of saving in tax deferred accounts. Tax deferred accounts provide the benefit of deferring all income and gain in the account from tax as long as there is no redemption from the account. Tax is deferred and paid only at the point of redemption. Two benefits are realized as a result of tax deferment. The first is that tax is deferred to a future date the benefit of which we will illustrate in the next paragraph. The second benefit is that, more often than not, redemption happens after retirement where effective tax slabs are lower and hence tax rate at redemption is likely to be lower than what it would have been at the point of income/gain generation.

Impact of tax deferral:

Imagine a fixed deposit of 1,00,000/- Rs earning 8% per year. The holder of this fixed deposit is in the 30% tax bracket. A tabulation of how this fixed deposit will grow over 10 years in a normal account versus a tax deferred account is shown in the table below:

In the above table, the impact of tax deferral boosts the effective post tax return by 0.52% - not trivial at all.

Tax deferred investments in India:

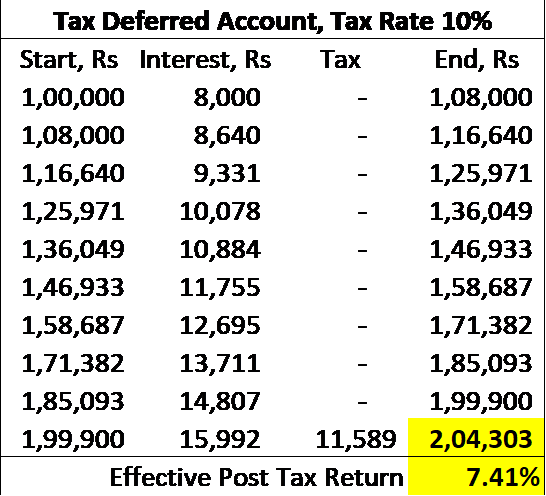

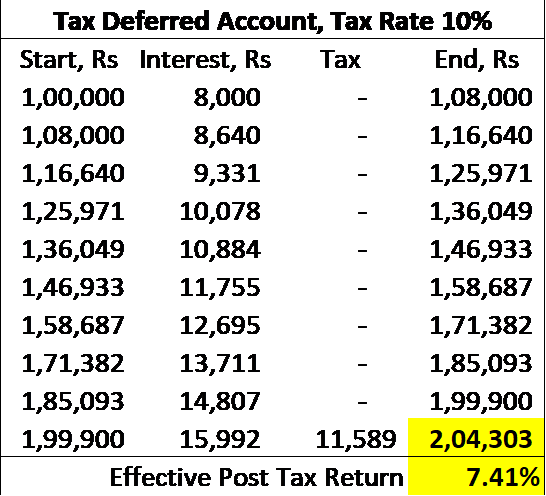

In India too we can construct tax deferred investments which can reap similar benefits. A typical example will be Debt and Equity mutual fund investments in the GROWTH mode. Note that in the GROWTH mode you pay tax on the Capital Gain only at the point of redemption as against DIVIDENDS which are taxed at the point of payout. With dividends now in India being taxed at the slab rate and Long Term Capital Gain tax rates at 10% – there is a double benefit of the GROWTH mode - tax deferral AND a lower rate of tax. This double benefit is illustrated in the table below where the Tax Deferred Account now has a lower tax rate of 10%. The effective post tax return rate is now a massive 1.81% higher than the standard account.

Confounding insurance and investing:

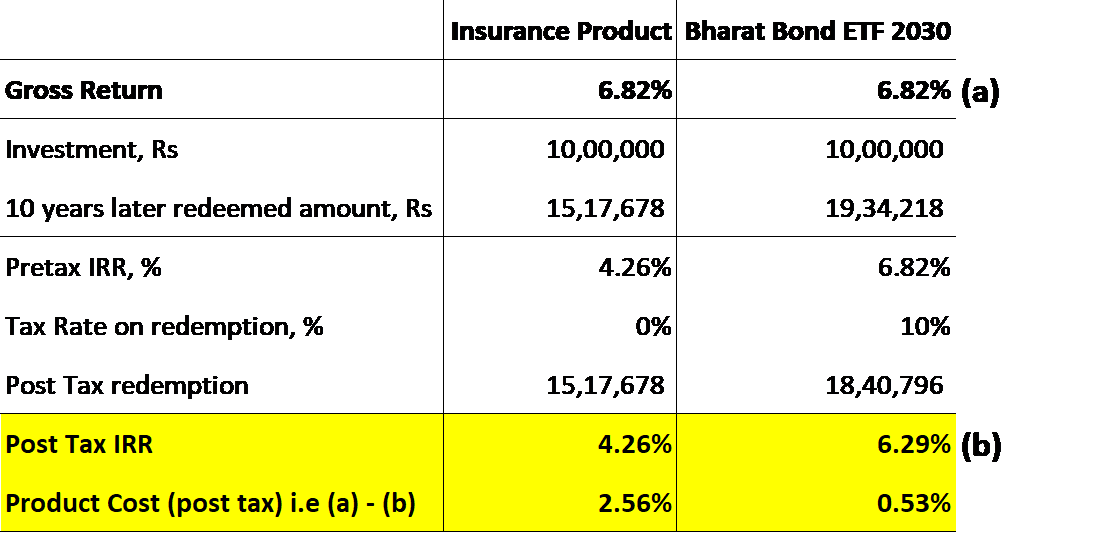

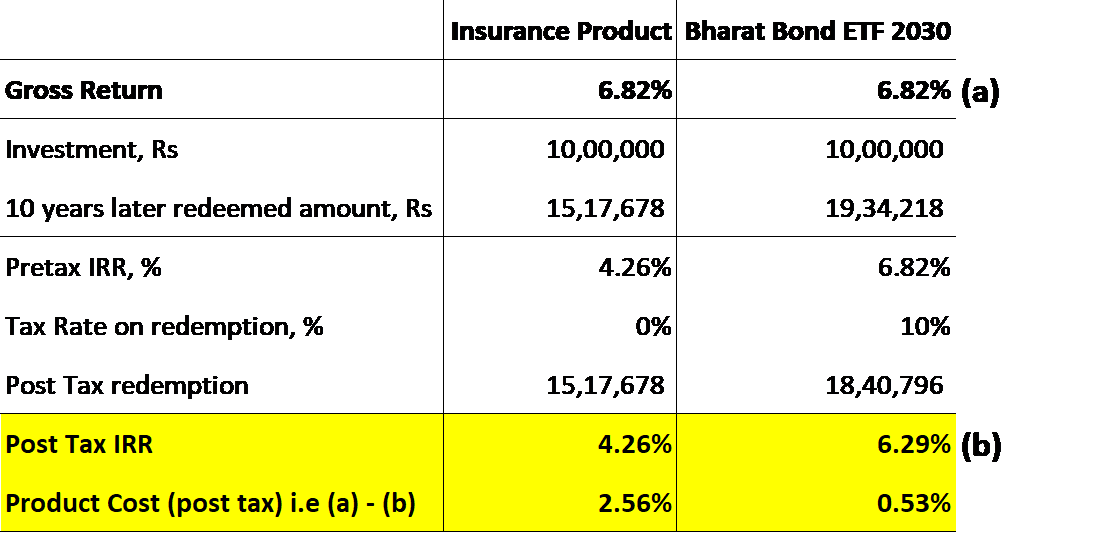

While tax deferral is a powerful tool to reduce tax incidence, Insurance companies market their products as investing products (rather than insurance products) stating their main benefit is proceeds of redemption is tax exempt under section 10(10D) of the IT act. Being tax exempt is likely to be better than being tax deferred – but this will be true only if the other costs associated with both the products are equal. I have mentioned in our earlier blog of 31-Jul-20, that invariably the cost of insurance products is such that the savings from being tax exempt is wiped out by the other costs of the insurance product – making the insurance product actually more expensive than similar mutual fund investments.. Two things are at play here – the first is the cost of the insurance product itself, and the other is the effective lower tax incidence due to tax deferral and lower tax rate at redemption of mutual fund products in the GROWTH mode. A table is given below to illustrate this idea. The numbers for the Insurance Product are plucked with some approximation from a proposal from an Indian insurer. The Gross Return for both the Insurance Product and the Mutual Fund Product (Bharat Bond ETF 2030) are assumed to be equal at 6.82%.

It can be seen in the table above, that even though the insurance product has 0% tax on redemption, the mutual fund product (Bharat Bond ETF) generates a net post tax return of 6.29% versus the insurance product generating a significantly lower net post tax return of 4.26%. By harvesting the benefits of tax deferment and a lower tax rate at redemption the Bharat Bond ETF turns out to be a superior product. Investors must be clear that even if a product is tax exempt it may not necessarily be a higher return product. This invariably is the draw-back of confounding insurance and investment in India. Insurance should be about protection while investing should about risk adjusted return. Investors must be clear about what they are seeking. Investors must also clearly understand the net effect of product costs and taxes before choosing an investment product.

Impact of tax deferral:

Imagine a fixed deposit of 1,00,000/- Rs earning 8% per year. The holder of this fixed deposit is in the 30% tax bracket. A tabulation of how this fixed deposit will grow over 10 years in a normal account versus a tax deferred account is shown in the table below:

In the above table, the impact of tax deferral boosts the effective post tax return by 0.52% - not trivial at all.

Tax deferred investments in India:

In India too we can construct tax deferred investments which can reap similar benefits. A typical example will be Debt and Equity mutual fund investments in the GROWTH mode. Note that in the GROWTH mode you pay tax on the Capital Gain only at the point of redemption as against DIVIDENDS which are taxed at the point of payout. With dividends now in India being taxed at the slab rate and Long Term Capital Gain tax rates at 10% – there is a double benefit of the GROWTH mode - tax deferral AND a lower rate of tax. This double benefit is illustrated in the table below where the Tax Deferred Account now has a lower tax rate of 10%. The effective post tax return rate is now a massive 1.81% higher than the standard account.

Confounding insurance and investing:

While tax deferral is a powerful tool to reduce tax incidence, Insurance companies market their products as investing products (rather than insurance products) stating their main benefit is proceeds of redemption is tax exempt under section 10(10D) of the IT act. Being tax exempt is likely to be better than being tax deferred – but this will be true only if the other costs associated with both the products are equal. I have mentioned in our earlier blog of 31-Jul-20, that invariably the cost of insurance products is such that the savings from being tax exempt is wiped out by the other costs of the insurance product – making the insurance product actually more expensive than similar mutual fund investments.. Two things are at play here – the first is the cost of the insurance product itself, and the other is the effective lower tax incidence due to tax deferral and lower tax rate at redemption of mutual fund products in the GROWTH mode. A table is given below to illustrate this idea. The numbers for the Insurance Product are plucked with some approximation from a proposal from an Indian insurer. The Gross Return for both the Insurance Product and the Mutual Fund Product (Bharat Bond ETF 2030) are assumed to be equal at 6.82%.

It can be seen in the table above, that even though the insurance product has 0% tax on redemption, the mutual fund product (Bharat Bond ETF) generates a net post tax return of 6.29% versus the insurance product generating a significantly lower net post tax return of 4.26%. By harvesting the benefits of tax deferment and a lower tax rate at redemption the Bharat Bond ETF turns out to be a superior product. Investors must be clear that even if a product is tax exempt it may not necessarily be a higher return product. This invariably is the draw-back of confounding insurance and investment in India. Insurance should be about protection while investing should about risk adjusted return. Investors must be clear about what they are seeking. Investors must also clearly understand the net effect of product costs and taxes before choosing an investment product.