In the current financial year, risky portfolios managed by us and benchmarked to market indices such as the BSE SENSEX price index or the BSE Small Cap Price Index have been severely under-performing. While I have been witnessing this underperformance since January this year, I felt it would be prudent to give this sometime before we comment upon our under-performance and take an overall view of the situation and undertake some corrective action if necessary on our strategy.

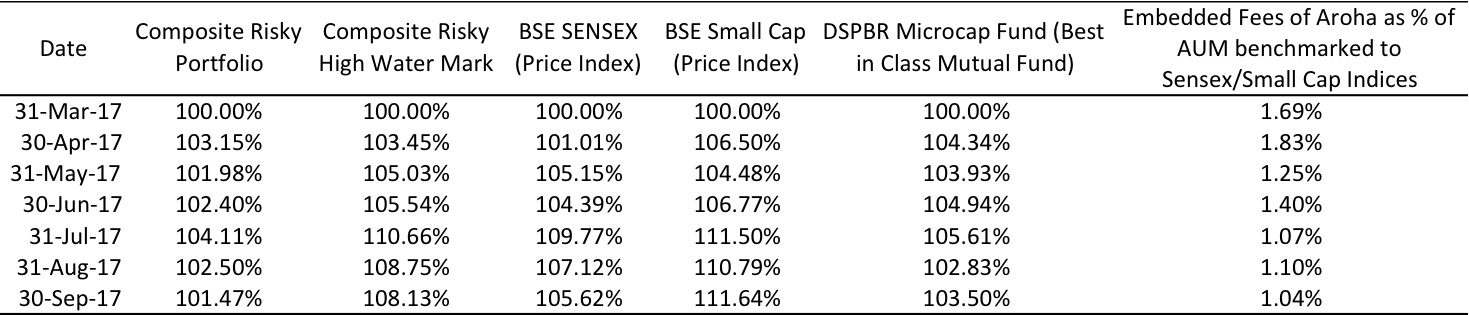

To give an idea of our level of underperformance, a table is given below:

To simplify analysis, we have presented a “Composite Risky Portfolio” which is the composite of all portfolios benchmarked against the BSE SENSEX price index or the BSE Small Cap price index. For comparison a “Composite Risky High Water Mark” is also presented in the adjacent column. A comparison of the Composite Portfolio (gone up by 1.47%) versus the Composite High Water Mark (gone up by 8.13%) indicates a 6.66% under-performance over the last 6 months.

The level of underperformance reported above is at a composite level and there is of-course variance from this average at the individual portfolio level. Furthermore under-performance in the portfolios benchmarked to the Small Cap price index is significantly worse. To give an idea, the worst portfolio has under-performed its benchmark (Small Cap price index) since 31-Mar-17 by a whopping ~16% !

Our investors need an answer to this level of underperformance and we will attempt to explain this without going into stock specifics. The first drag on portfolio performance has been the levels of cash we hold. Since December last year, we have been having quite a bit of fresh cash pouring into risky portfolios which we have unfortunately not been able to deploy fast enough due to a lack of investible opportunities at a fair price. We take the criticism that if there are no investible opportunities in the risky portfolio space, one should not be taking any incremental advice mandates from clients and holding it as cash. When the client has provided an explicit mandate to take on risky assets it may be considered a violation of fiduciary duty in not deploying the same. We are seriously considering this option going forward i.e stop accepting future portfolio mandates against risky benchmarks for a period of time till fresh investible opportunities crop up.

Nevertheless, in our defense, I would say that not deploying money when stocks are priced for perfection (at-least as per our thesis) is also a fiduciary duty and in that sense, we have protected clients invested in risky portfolios against massive draw-downs. To give a sense, although the worst portfolio has underperformed by about 16%, even a best in class mutual fund the DSPBR Micro-cap has under-performed the Small Cap price index by about 8%. In the same breath, it must be mentioned that the absolute worst loss to clients from their original deployed money is ~2%. So, clients have lost very little in absolute terms. Also in the case of a very sharp future decline in the broad markets, client portfolios are protected to the extent of cash they hold.

The second drag and the more important one to us, is that, even in the invested corpus of stocks, our stock picks have not done well over the whole of this calendar year. Our thesis has been to invest in businesses which have had and will continue to demonstrate a reasonable return on invested capital, have opportunities for non-linear growth in the bottom line, have significant promoter holding and demonstrate high quality earnings (meaning very low working capital and strong free cash flows) and all this at a price which provides enough cushion to provide a long term price appreciation north of 12% over our investment horizon. Furthermore we are careful in avoiding over exposure to individual stocks so that risk is contained by prudent stock level allocation. Most stocks in our risky portfolios have significantly underperformed benchmark indices. With the exception of one stock, we have seen no change in their fundamentals. The stock in exception has since been exited out of client portfolios.

Maybe the answer lies in the indices and what is rising amongst their constituents? A quick perusal of the Small Cap index major constituents indicates close 40% of it is made of highly leveraged financial, capital goods and housing related businesses. On the other hand a majority of our stock ideas have little or no leverage and relatively large positions in cash. Highly leveraged stocks tend to outperform in bull markets and likewise significantly under-perform in bear markets. We are not experts on the Small Cap index, but we do think that this is one major explanation for our under-performance.

To give an idea about the level of exuberance in the Small Cap index, the Price to Earnings ratio of the index currently stands at a whopping 76.35!! Indicating an earnings yield of barely 1.3% and (if one were to assume a discount rate of 12%) the implied growth rate in earnings is about 11% to eternity !! I am circumspect about this. I may be proved incorrect, as I have been over the past 10 months. In comparison, the average Price to Earnings Ratio in our basket of risky stock ideas hovers at a more modest ~18 with an implied growth rate in earnings of about 6%.

It could be that many of our stock ideas are in-fact duds and value traps and that there is a reason they have not risen commensurate with the market at large – to this I have two things to say: (a) Clients ultimately are making a judgement call on our skills as an investment adviser and it is a risk that they bear if we were to consistently under-perform even over the next 4 years. Clients are of-course free to dis-engage if they find superior managers elsewhere and (b) We at Aroha not only do not get compensated when we under-perform but even our retained fee in client portfolios will be eaten up. To get an idea, look at the last column of the table above. Our fees embedded in client accounts (in risky portfolios), has dropped from about 1.69% to about 1.04% of assets under advice. Indicating a close to 40% drop in our embedded fees. If it is any consolation, due to this under-performance, we at Aroha are hurting much more than you - our clients.