With the raging controversy surrounding the restrictions the Government of India proposed in the recent budget around provident fund withdrawals, specifically with the insistence of taking up single premium annuities with matured pensions, I felt it relevant to dig into a typical annuity and understand what this product could offer retirees. The annuity, which I wish to cover here, is one where a one-time premium is paid to the insurance company for a guaranteed annual payout for life, plus a return of the original premium on death of the annuitant. Not only is this the simplest form of an annuity, but it is also amenable to a straightforward comparison with other normal debt products – which is the normal investment vehicle for most Indian retirees.

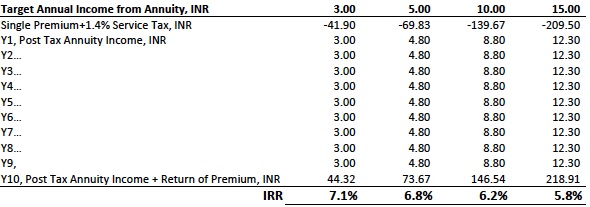

Before we proceed to our comparison, it would be relevant to cover certain important tax considerations that govern annuities. First - all annuity proceeds (except the return of the premium) is considered income in the hands of the annuitant and is subject to income tax at the tax rates and tax slabs of the annuitant. Second - the one time premium paid to the insurance company has a service tax component which is 1.4% of the total premium. Taking into account the tax considerations highlighted above (and ignoring a small INR 2,000/- tax credit claimable U/S 87A), the table below shows the post-tax rates of return a typical annuity (taken by a 60 year old) can generate. It is assumed that the annuity lasts for 10 years and then it terminates and the premium is returned:

Note : All amounts in the table above are in lakh INR except the IRR (Internal Rate of Return) numbers which are in %

The table indicates that under the most favorable tax slab when annuity income is INR three lakh or lower, a typical annuity generates a post-tax IRR (Internal Rate of Return) of 7.1%. At annuity incomes of INR 15 lakh, the post-tax return drops to 5.8%. Currently, a one-year fixed deposit gives an interest of 7.5%, which is higher than even the most favorable tax rate (0.0%) under which an annuity is considered.

From a return perspective, an annuity does not make the cut as discussed in the previous paragraph, but it certainly generates a steady flow of income till death for the annuitant. This steady and guaranteed source of income is a massive draw for retirees. However, quasi government tax free bond issues are trading in the market at a yield to maturity of 7.0% – and since the interest on these bonds is tax free, a retiree can generate guaranteed returns of ~7.0% per annum for at least 15 more years (if one were to buy any of the recent tax-free issues which have a 15 year term) without any tax implications for any income level. In other words, as a retiree’s income needs rise significantly beyond INR three lakh per annum, tax-free issues would beat annuities hands-down. Of course after 15 years when the tax-free issues mature, there be will be a re-investment risk.

While it is a desire that the retiree seeks to hold his investment till maturity, a point that needs further elaboration is that the interest sensitivity of an annuity is zero. In other words, whether the interest rates go up or down, the annual annuity payout and the return of the premium do not change. However, in a tax-free bond there is interest rate sensitivity (duration risk) and when interest rates go down there can be capital appreciation which can give rise to opportunistic gains. Of course if interest rates go up, these very same tax-free issues would suffer a notional capital loss, which in any case need not be realized since the retiree always has the option to hold the bond till maturity.

The nail in the annuity coffin however, is its lack of optionality. Giving up optionality to ensure a steady source of income is fine, provided this is to cover the bare minimum of expenses of a retiree. Beyond these bare minimum needs that an annuity may cover, the retiree is better off generating rather uncertain returns through market linked instruments while retaining significant optionality on his side.

I must place a disclaimer that there may be specific and unique circumstances that may apply to individuals that may make annuities more attractive. I am eager to receive alternate views on annuities from my readers – so please feel to drop in an email.