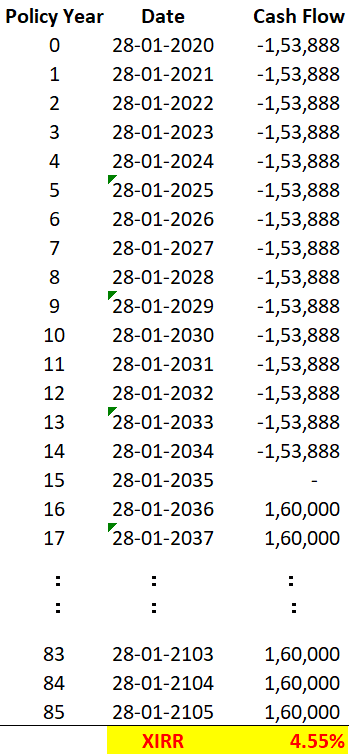

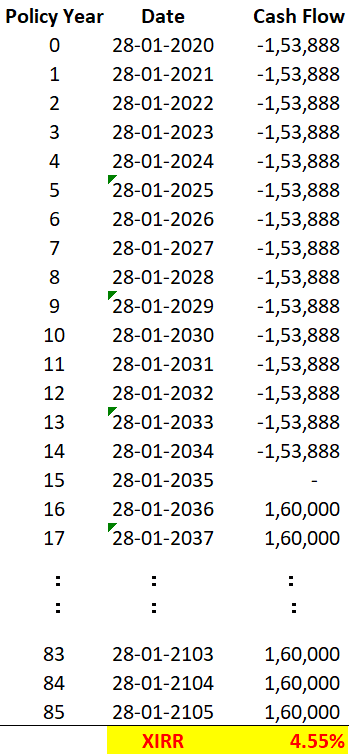

Many non-term/non-ULIP life insurance policies are notorious for offering expensive plans with high embedded commissions. Most of these plans generate sub-inflationary returns even over very long time horizons, significantly destroying wealth and purchasing power of the investor. As in a recent example, the investor falls for a slick sales pitch claiming 8% of Sum Assured every year. The policy is a guaranteed policy, and the cash flows are guaranteed, so where is the catch? The catch is in the time after which the 8% returns are paid out – in this recent case after 15 years (the premium paying term). Unable to grasp the time value of money, it is but natural for a novice investor to fall for such traps. The cash flow table below illustrates that for a Sum Assured of 20 lakh, the investor pays a premium of 1.53 lakh/annum for 15 years and from the end of the 15th year starts getting 8% of 20 lakh ie 1.60 lakh/annum for the next 70 years. While this may seem like an 8% return product, in reality the XIRR of this product is 4.55% - clearly sub-inflationary and wealth destroying.

The discussion above, proves that the policy under consideration is wealth destroying. The investor has completed paying 5 premiums and has 10 more premiums to go. The decision now is without doubt to stop paying future premiums and prevent any further wealth destruction. The question remains whether the investor should “Surrender” the policy with penalties or allow it to continue under the status of “Paid Up”. This is the subject of this blog ie how does an investor decide between the Surrender and Paid-Up options?

Surrender versus Paid-up

The tables provided by the insurer, indicated that on surrender in the 5th year, the Guaranteed Surrender Value the investor will get 50% of the total premiums paid till date (1.53 lakh x 5 x 0.50) + 7.7% of the vested bonus (6.40 lakh x 0.077) = 4.34 lakh. However in this case a Special Surrender Value of 6.29 lakh was payable and it being higher than the Guaranteed Surrender Value, 6.29 lakh was the final amount payable to the investor in the case of policy surrender.

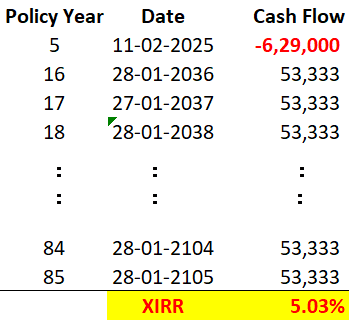

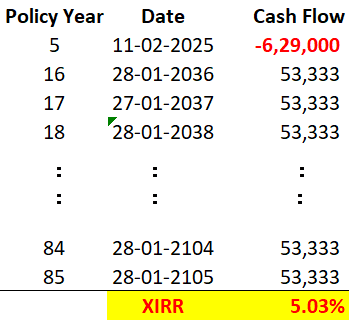

Under the paid-up option, as the investor has paid 5 premiums out of 15, the Paid Up Sum Assured is reduced to 5/15 x 20 lakh = 6.67 lakh. If the investor decides to take this Paid-Up option, he will get 8% of this revised Sum Assured (8% x 6.67 lakh = 0.53 lakh) every year starting from the end of 15th year up-to year 85 of the policy. So we need to know what is the rate of return that we will be obtained by “investing” 6.29 lakh today (Surrender Value) to get a payout of Rs 53k every year for 70 more years starting 11 years from today. The solution for this question is presented in the cash flow table below. The XIRR works out to be 5.03%.

If the investor believes he will be able to generate a higher return than 5.03% on the Surrender Value of 4.34 lakh, he will be advised to opt for the Surrender Option – else he can chose the Paid-Up option and allow the money to stay invested with the policy. This is a back of the envelop calculation and is subject to error. Nevertheless, the exact values do not matter as much as the approach we are attempting to illustrate.

The discussion above, proves that the policy under consideration is wealth destroying. The investor has completed paying 5 premiums and has 10 more premiums to go. The decision now is without doubt to stop paying future premiums and prevent any further wealth destruction. The question remains whether the investor should “Surrender” the policy with penalties or allow it to continue under the status of “Paid Up”. This is the subject of this blog ie how does an investor decide between the Surrender and Paid-Up options?

Surrender versus Paid-up

The tables provided by the insurer, indicated that on surrender in the 5th year, the Guaranteed Surrender Value the investor will get 50% of the total premiums paid till date (1.53 lakh x 5 x 0.50) + 7.7% of the vested bonus (6.40 lakh x 0.077) = 4.34 lakh. However in this case a Special Surrender Value of 6.29 lakh was payable and it being higher than the Guaranteed Surrender Value, 6.29 lakh was the final amount payable to the investor in the case of policy surrender.

Under the paid-up option, as the investor has paid 5 premiums out of 15, the Paid Up Sum Assured is reduced to 5/15 x 20 lakh = 6.67 lakh. If the investor decides to take this Paid-Up option, he will get 8% of this revised Sum Assured (8% x 6.67 lakh = 0.53 lakh) every year starting from the end of 15th year up-to year 85 of the policy. So we need to know what is the rate of return that we will be obtained by “investing” 6.29 lakh today (Surrender Value) to get a payout of Rs 53k every year for 70 more years starting 11 years from today. The solution for this question is presented in the cash flow table below. The XIRR works out to be 5.03%.

If the investor believes he will be able to generate a higher return than 5.03% on the Surrender Value of 4.34 lakh, he will be advised to opt for the Surrender Option – else he can chose the Paid-Up option and allow the money to stay invested with the policy. This is a back of the envelop calculation and is subject to error. Nevertheless, the exact values do not matter as much as the approach we are attempting to illustrate.