As SEBI Registered Investment Advisers, a corner-stone of our investment philosophy has been to choose low cost index funds. Our rationale has been that low cost index funds are sufficient in meeting the equity exposure requirements of most of our clients. In cases where an active strategy is desired we have chosen to either directly hold shares or chose an exemplary active manager who does quality research and has a fee structure that charges primarily for performance only. With index investing being important to our investing philosophy, it becomes our fiduciary responsibility to scour the Indian fund landscape for index funds that track their chosen benchmarks with the lowest possible drag. Traditionally there are two measures that indicate the quality of an index fund. The first being the cost of running an index fund defined as the Total Expense Ratio (TER) of the fund. The second being Tracking Error which is the variability in the difference in return between the Nett Asset Value (NAV)of index fund return and the return of the benchmark. Our logic has been that the lower TER and Tracking Error are, the more closely the funds will track their benchmarks. Before we go any further, it would be useful to define how TER and Tracking Error are calculated.

Total Expense Ratio (TER):

Regulation 52, sub-regulations (1) to (5A) of the SEBI Mutual Fund Regulations 1996, provides in detail the various heads under which expenses can be charged to a fund. This includes Investment Advisory Fees, Marketing and Selling Expenses including agent’s commission, Brokerage and Transaction Costs, Registrar Services, Fees and Expenses of Trustees, Audit Fees, Custodian Fees and other line items which are not salient to our discussion here. It would be normal to expect that total costs associated with this exhaustive list of line items would be the Total Expense Ratio (TER). However, the regulations are a little opaque on the precise definition of TER. The typical nomenclature followed by fund houses is that TER includes all the above – except brokerage and transaction costs which are real and create significant drag on the returns of the fund. So just because a fund states that its TER is 0.1% does not mean that all the costs involved in running the fund are included in this TER. To further complicate matters, the regulations state that brokerage costs of 0.12% (cash) + 0.30% (for costs associated with inflows from tier II cities) + 0.05% (other expenses) can be added – which means that even if a TER of 0.1% is stated in the fund fact sheet, the regulatory limit (at-least to our understanding) on costs would be 0.1% + 0.12% + 0.30% + 0.05% = 0.57% !! We are still in discussion with at-least two fund houses to understand this with more clarity.

Tracking Error:

It is clear that the returns of any index fund is likely to lag the returns of its benchmark, specifically due to the costs associated with running the fund. While the investor would like this lag to be minimal, what is also of interest to investors, is the consistency of this lag. If the lag in returns between the fund and its index is consistent (low standard deviation), we can assume that that the fund tracks the index consistently (although with a lag). On the other hand if the lag is very inconsistent, the implication is that not only is there a lag, but the inconsistency in the lag, gives more uncertainty to the investor on how closely he is mirroring the index. Ideally investors would like to see high consistency in the lag in returns of the fund with respect to the index. Tracking Error is the standard deviation of the difference in returns between the index and the fund. A lower Tracking Error means that there is less volatility in the fund with respect to its index. A lower Tracking Error also provide more certainty to the investor as regards the Net Asset Value at which he buys or sells units.

Tracking Difference (TD):

As discussed above, the total expenses experienced by the fund are likely to be far in excess of the TER reported in fund fact sheets. While scouring the land scape for low cost index funds, we have restricted ourselves to studying the fund fact sheets – which as we have argued can be misleading. What then can give us a better measure of the costs involved in running an index fund? The answer lies in a measure largely ignored by Indian investors and not mentioned in the fund fact sheets – this is the Tracking Difference (TD). The Tracking Difference is how much the NAV of index fund return lags behind its benchmark return on an annualized basis. In other words - what is the “actual” difference in returns experienced by the investor between the fund and the index on an annualized basis ?

Calculating the Tracking Difference of an index fund is straight forward. One needs to tabulate the benchmark values on a daily basis and the corresponding reported Net Asset Values of the fund. On a daily basis one can then calculate the daily return of both (the benchmark and the index fund). After this the difference between the return of the benchmark and the index fund is calculated on a daily basis. The average daily difference between the benchmark return and the index fund return is then annualized by raising it to the power of 250 (number of working days in a year). This value indicates the “actual” difference in return experienced by the investor vis-a vis the index benchmark. Enclosed is an excel file showing calculations of annualized Tracking Error and Tracking Difference for two prominent index mutual funds and two prominent index ETFs following the NIFTY Total Return Index (NIFTY TRI).

Some real data:

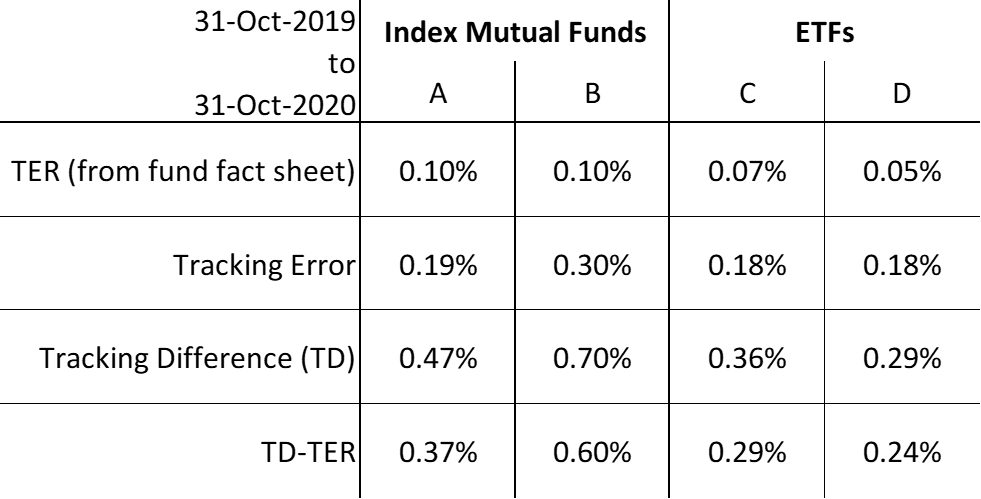

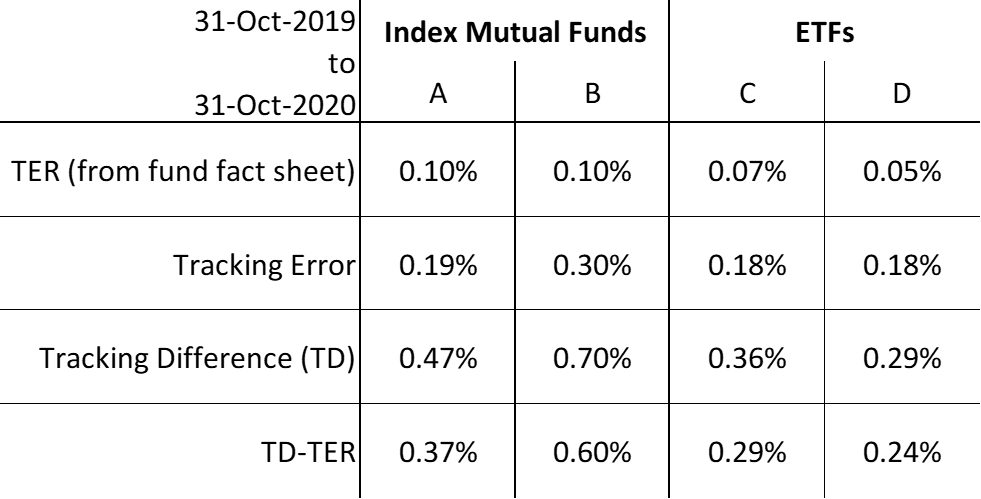

Given below is a table that summarizes the Total Expense Ratio (TER), Tracking Error and Tracking Difference (TD) of two prominent index mutual funds and two prominent index ETFs.

Some conclusions that can be drawn from the above table are :

Total Expense Ratio (TER):

Regulation 52, sub-regulations (1) to (5A) of the SEBI Mutual Fund Regulations 1996, provides in detail the various heads under which expenses can be charged to a fund. This includes Investment Advisory Fees, Marketing and Selling Expenses including agent’s commission, Brokerage and Transaction Costs, Registrar Services, Fees and Expenses of Trustees, Audit Fees, Custodian Fees and other line items which are not salient to our discussion here. It would be normal to expect that total costs associated with this exhaustive list of line items would be the Total Expense Ratio (TER). However, the regulations are a little opaque on the precise definition of TER. The typical nomenclature followed by fund houses is that TER includes all the above – except brokerage and transaction costs which are real and create significant drag on the returns of the fund. So just because a fund states that its TER is 0.1% does not mean that all the costs involved in running the fund are included in this TER. To further complicate matters, the regulations state that brokerage costs of 0.12% (cash) + 0.30% (for costs associated with inflows from tier II cities) + 0.05% (other expenses) can be added – which means that even if a TER of 0.1% is stated in the fund fact sheet, the regulatory limit (at-least to our understanding) on costs would be 0.1% + 0.12% + 0.30% + 0.05% = 0.57% !! We are still in discussion with at-least two fund houses to understand this with more clarity.

Tracking Error:

It is clear that the returns of any index fund is likely to lag the returns of its benchmark, specifically due to the costs associated with running the fund. While the investor would like this lag to be minimal, what is also of interest to investors, is the consistency of this lag. If the lag in returns between the fund and its index is consistent (low standard deviation), we can assume that that the fund tracks the index consistently (although with a lag). On the other hand if the lag is very inconsistent, the implication is that not only is there a lag, but the inconsistency in the lag, gives more uncertainty to the investor on how closely he is mirroring the index. Ideally investors would like to see high consistency in the lag in returns of the fund with respect to the index. Tracking Error is the standard deviation of the difference in returns between the index and the fund. A lower Tracking Error means that there is less volatility in the fund with respect to its index. A lower Tracking Error also provide more certainty to the investor as regards the Net Asset Value at which he buys or sells units.

Tracking Difference (TD):

As discussed above, the total expenses experienced by the fund are likely to be far in excess of the TER reported in fund fact sheets. While scouring the land scape for low cost index funds, we have restricted ourselves to studying the fund fact sheets – which as we have argued can be misleading. What then can give us a better measure of the costs involved in running an index fund? The answer lies in a measure largely ignored by Indian investors and not mentioned in the fund fact sheets – this is the Tracking Difference (TD). The Tracking Difference is how much the NAV of index fund return lags behind its benchmark return on an annualized basis. In other words - what is the “actual” difference in returns experienced by the investor between the fund and the index on an annualized basis ?

Calculating the Tracking Difference of an index fund is straight forward. One needs to tabulate the benchmark values on a daily basis and the corresponding reported Net Asset Values of the fund. On a daily basis one can then calculate the daily return of both (the benchmark and the index fund). After this the difference between the return of the benchmark and the index fund is calculated on a daily basis. The average daily difference between the benchmark return and the index fund return is then annualized by raising it to the power of 250 (number of working days in a year). This value indicates the “actual” difference in return experienced by the investor vis-a vis the index benchmark. Enclosed is an excel file showing calculations of annualized Tracking Error and Tracking Difference for two prominent index mutual funds and two prominent index ETFs following the NIFTY Total Return Index (NIFTY TRI).

Some real data:

Given below is a table that summarizes the Total Expense Ratio (TER), Tracking Error and Tracking Difference (TD) of two prominent index mutual funds and two prominent index ETFs.

Some conclusions that can be drawn from the above table are :

- Total Expense Ratio (TER) is a poor indicator of fund costs. The extra cost to the investor over the TER i.e TD-TER is about 4x to 6x the TER!! Apparently there is nothing "Total" in TER.

- Even though two index mutual funds (A and B) have the same reported Total Expense Ratio (TER), they can differ vastly in their Tracking Difference (TD). In this case index mutual fund A has a TD of 0.47% while index mutual fund B has a TD of 0.70%, in-spite both reporting an equal TER of 0.10%. In fund fact sheets only TER is reported and not TD. This means that an inspection of the fund fact sheets is not only insufficient but may be misleading. Data indicates that that there are index mutual funds with TERs less than 0.10% but with TDs above those shown in the table above. A deeper analysis with the daily NAVs of the fund needs to be done to get a more realistic picture of which index fund is better. Clearly the word “Total” in TER is misleading.

- Index ETFs have significantly lower Tracking Differences (TD) than index mutual funds. This is expected because in the case of index mutual funds, investors buy and sell units at the end of day Nett Asset Value (NAV) reported by the index mutual fund. The index mutual fund bears the cost of unit purchases and redemptions by investors. Every time an investor decides to buy/sell units, the index mutual fund needs to buy/sell the underlying securities which will involve brokerage costs charged to the fund. On the other hand as the product manager of a prominent fund house pointed out to us, ETF units are bought on the exchanges by buying and selling between investors at prices discovered by the market. There is no cost to the ETF when units change hands. Even in the case of issue of fresh ETF units, the brokerage cost involved in the creation of such units is charged to the investor and not the ETF. On the other hand, since ETFs are primarily sold/bought on the stock exchanges, the price at which an investor buys/sells an ETF is not at the nett asset value (NAV) of the ETF but at a price discovered by the market (which is hopefully close to the NAV of the ETF). Since one has to buy at the lowest ask price and sell at the highest bid price, there is bound to be deviation between transaction price and NAV of the ETF. Further in times of extreme market volatility there can be large variances between the price discovered by the market and the actual NAV of the ETF - this can be particularly worrying when secondary market liquidity dries up and bid-ask spreads widen. A detailed inspection of the bid-ask spreads and their deviations from the ETF NAV are also required to be examined to get more clarity. The implication is that Tracking Difference is an important measure for index mutual funds, while for ETFs though useful, it still does not provide the complete picture - the reason being the impact of secondary market trading and price discovery.

- Index mutual funds can be held in physical folio form or in a demat form. While ETFs have to be necessarily held in a demat form. This difference along with the other intricacies involved in buying/selling ETFs, in our opinion imply that a low cost index mutual fund is the simpler instrument for the normal investor.

- SEBI must be petitioned to get index funds to include Tracking Difference in their index mutual fund and index ETF fact sheets. This does not require any extra work from the fund houses – in any case Tracking Error which is already being reported uses the very same data.

- A useful website to refer to for index mutual funds and ETFs in the Indian context is PassiveFunds.in. This website explains in detail the nuances of index mutual funds and ETFs. It also has a pretty exhaustive data compilation of Indian index funds that can provide insight to the inclined investor.