In our blog of Report Card : 31-Mar-20 we presented our performance on a consolidated basis. Performance was reported on a Time Weighted Return (TWRR) basis as against an Internal Rate of Return (IRR) basis. It is critical that investors understand the difference between the two modes of return calculation. Dramatically different results between the two can be obtained under certain circumstances.

Time Weighted Rate of Return (TWRR):

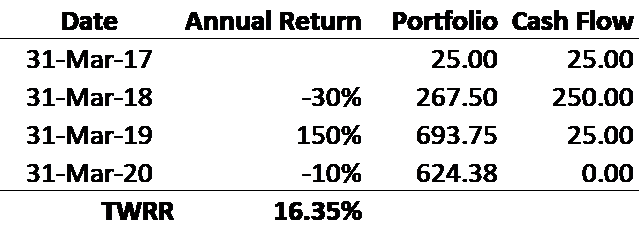

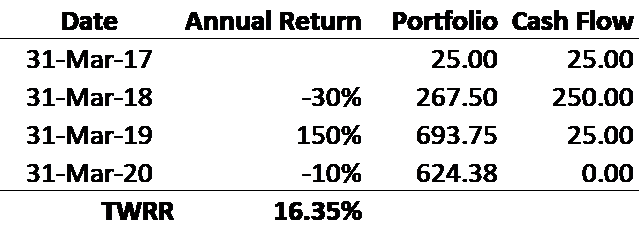

The TWRR calculation eliminates the impact of cash flows. Every period return is calculated by eliminating the impact of external cash flows on the portfolio. A period is defined as the time between any two cash flows. After cumulating all such period returns the annualized return is calculated. Consider the below table. Cash flows of Rs 25, Rs 250 and Rs 25 occur on 31-Mar of 2017, 2018 and 2019 respectively. The annual (period) returns are calculated by eliminating the cash flow impact in each period. For example the annual return for the period 31-Mar-17 to 31-Mar-18 is calculated as :

Table-1

The calculation methodology of TWRR implies that rate of return is independent of intermediate cash flows. It is generally believed that TWRR is a superior method to explain adviser performance since external cash flows are not in his control. The rationale is that it is the investor who decides when to fund the portfolio and when to not fund/withdraw funds from the portfolio – and assigning the merit/de-merit of timing the cash flows to the adviser is inappropriate.

Internal Rate of Return (IRR):

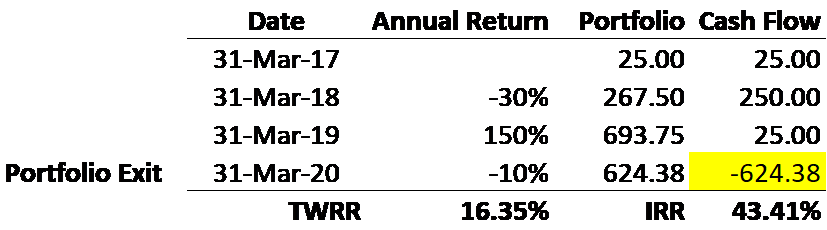

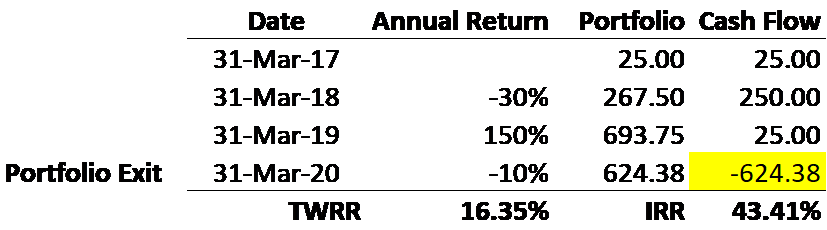

While it may be reasonable to use TWRR to explain adviser performance, in many cases what the adviser reports on a TWRR basis can be at odds with what the client actually experiences. To the table above we add one more data point – i.e on 31-Mar-20, the investor decides to withdraw his entire portfolio :

Table-2

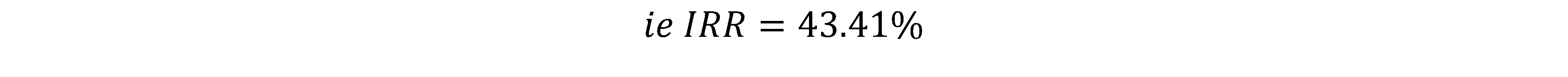

In the table above, the cash flow on 31-Mar-20 is the negative of the portfolio value, since the entire portfolio is being withdrawn. At this point in time, how can we capture what the investor has experienced? We say that the investor’s return experience is closer to the reported Internal Rate of Return (IRR) of 43.41%. How is this IRR calculated and why does it more appropriately capture investor experience? IRR is the rate applied to all cash flows into/out of the portfolio for the period that cash flow is relevant such that the net value is zero. So in the above example we would say:

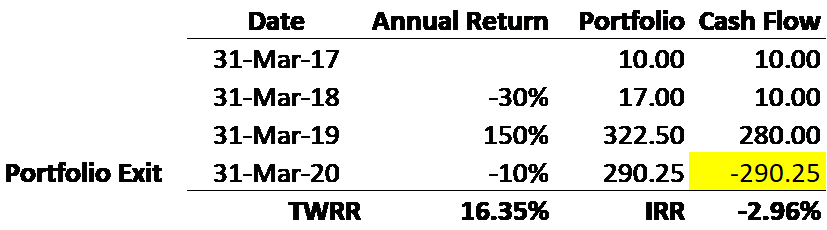

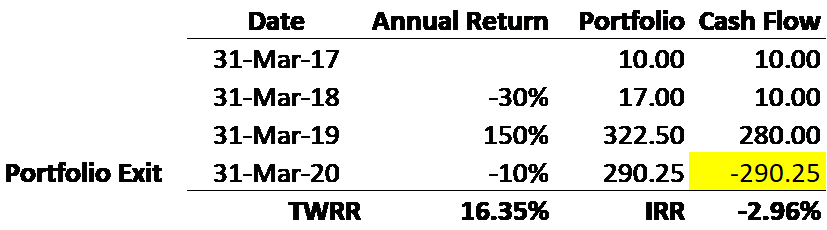

The difference between TWRR and IRR in effect, we dare may say is the difference between market returns and investor experienced returns. The major reason for the difference between TWRR and IRR is related to the timing of cash flows. The bulk of the cash flows (250 Rs) from the investor into the portfolio were on 31-Mar-18 and in the subsequent period (31-Mar-18 to 31-Mar-19), the annual return was 150%. Only a small portion of the cash flow experienced the large negative return of -30% in the previous year and a bulk of the cash flow experienced the large subsequent period return of 150%. In other words IRR is the cash weighted return of the portfolio – which is what the investor experiences in reality. To put the contrast between TWRR and IRR more starkly – study the table below:

Table-3

In the table above, the annual period returns remain the same, however we have changed the cash flows. A very small portion of the cash flow is exposed to the large negative return of -30% and the subsequent large positive return of 150%. A bulk of the cash flow is exposed to the -10% return in the last period (31-Mar-19 to 31-Mar-20) and hence the IRR of -2.96% reflects that experience. The TWRR however remains the same as earlier, ie 16.35%. Through this we understand that while TWRR presents performance from the view point of the adviser, IRR presents performance from the view point of the investor. However, investors must be wary of the IRR method especially when the bulk of the cash flows are exposed to shorter durations of time in the portfolio. For example a one month absolute return of 5% in the portfolio, when annualized by IRR will be shown to be 79.58%. We have hence refrained from reporting IRR in your portfolios till very recently. As a bulk of our clients have been with us for north of 3 years, we felt it is time to include IRR reporting in your holding reports.

So what are the implications for the differences between TWRR and IRR? The first implication is for performance fee calculation. Performance fee of an adviser must be calculated only on an IRR basis and not on a TWRR basis – this is indeed how we have constructed performance fee calculation. The concept of the high water mark and it compounding at the benchmark rate is intrinsically the IRR methodology. The second implication is that to judge adviser performance, TWRR is probably more fair to the adviser. Over short periods of time and/or with lumpy cash flows, IRR fluctuates wildly, which brings us to the third implication in that it is definitely not appropriate to judge an adviser by IRR if the time periods of relevant cash flows are low (in our minds south of 5 years). Funnily what comes out from this discussion, is that judging the performance of an adviser and calculating performance fee may be at loggerheads – this is particularly amplified when the period over which an adviser is judged is short.

Time Weighted Rate of Return (TWRR):

The TWRR calculation eliminates the impact of cash flows. Every period return is calculated by eliminating the impact of external cash flows on the portfolio. A period is defined as the time between any two cash flows. After cumulating all such period returns the annualized return is calculated. Consider the below table. Cash flows of Rs 25, Rs 250 and Rs 25 occur on 31-Mar of 2017, 2018 and 2019 respectively. The annual (period) returns are calculated by eliminating the cash flow impact in each period. For example the annual return for the period 31-Mar-17 to 31-Mar-18 is calculated as :

Table-1

The calculation methodology of TWRR implies that rate of return is independent of intermediate cash flows. It is generally believed that TWRR is a superior method to explain adviser performance since external cash flows are not in his control. The rationale is that it is the investor who decides when to fund the portfolio and when to not fund/withdraw funds from the portfolio – and assigning the merit/de-merit of timing the cash flows to the adviser is inappropriate.

Internal Rate of Return (IRR):

While it may be reasonable to use TWRR to explain adviser performance, in many cases what the adviser reports on a TWRR basis can be at odds with what the client actually experiences. To the table above we add one more data point – i.e on 31-Mar-20, the investor decides to withdraw his entire portfolio :

Table-2

In the table above, the cash flow on 31-Mar-20 is the negative of the portfolio value, since the entire portfolio is being withdrawn. At this point in time, how can we capture what the investor has experienced? We say that the investor’s return experience is closer to the reported Internal Rate of Return (IRR) of 43.41%. How is this IRR calculated and why does it more appropriately capture investor experience? IRR is the rate applied to all cash flows into/out of the portfolio for the period that cash flow is relevant such that the net value is zero. So in the above example we would say:

The difference between TWRR and IRR in effect, we dare may say is the difference between market returns and investor experienced returns. The major reason for the difference between TWRR and IRR is related to the timing of cash flows. The bulk of the cash flows (250 Rs) from the investor into the portfolio were on 31-Mar-18 and in the subsequent period (31-Mar-18 to 31-Mar-19), the annual return was 150%. Only a small portion of the cash flow experienced the large negative return of -30% in the previous year and a bulk of the cash flow experienced the large subsequent period return of 150%. In other words IRR is the cash weighted return of the portfolio – which is what the investor experiences in reality. To put the contrast between TWRR and IRR more starkly – study the table below:

Table-3

In the table above, the annual period returns remain the same, however we have changed the cash flows. A very small portion of the cash flow is exposed to the large negative return of -30% and the subsequent large positive return of 150%. A bulk of the cash flow is exposed to the -10% return in the last period (31-Mar-19 to 31-Mar-20) and hence the IRR of -2.96% reflects that experience. The TWRR however remains the same as earlier, ie 16.35%. Through this we understand that while TWRR presents performance from the view point of the adviser, IRR presents performance from the view point of the investor. However, investors must be wary of the IRR method especially when the bulk of the cash flows are exposed to shorter durations of time in the portfolio. For example a one month absolute return of 5% in the portfolio, when annualized by IRR will be shown to be 79.58%. We have hence refrained from reporting IRR in your portfolios till very recently. As a bulk of our clients have been with us for north of 3 years, we felt it is time to include IRR reporting in your holding reports.

So what are the implications for the differences between TWRR and IRR? The first implication is for performance fee calculation. Performance fee of an adviser must be calculated only on an IRR basis and not on a TWRR basis – this is indeed how we have constructed performance fee calculation. The concept of the high water mark and it compounding at the benchmark rate is intrinsically the IRR methodology. The second implication is that to judge adviser performance, TWRR is probably more fair to the adviser. Over short periods of time and/or with lumpy cash flows, IRR fluctuates wildly, which brings us to the third implication in that it is definitely not appropriate to judge an adviser by IRR if the time periods of relevant cash flows are low (in our minds south of 5 years). Funnily what comes out from this discussion, is that judging the performance of an adviser and calculating performance fee may be at loggerheads – this is particularly amplified when the period over which an adviser is judged is short.