with Sahil Chhabria, Junior Analyst Aroha Capital

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold, issued by the Government of India through the Reserve Bank of India (RBI). Instead of holding physical gold, investors hold a financial instrument whose value is linked to the prevailing market price of gold. SGBs are backed by the sovereign guarantee of the Government of India, making them virtually free from default risk. They provide investors with exposure to gold price movements while avoiding the costs, risks, and inefficiencies associated with holding physical gold. The Government of India introduced Sovereign Gold Bonds in 2015 as part of its broader Gold Monetisation and Financialisation Strategy.

SGBs are denominated in grams of gold, issued in dematerialised or certificate form and are tradable on stock exchanges after issuance. SGBs carry a fixed annual coupon of 2.50% (the initial few issues had a 2.75% coupon), calculated on the initial issue price. SGBs have a maximum tenure of 8 years with early redemption allowed after 5 years on interest payment dates. At maturity, redemption is based on average IBJA gold price of the preceding three working days. Capital gains on redemption at maturity are fully exempt for individuals. Capital gains taxes however apply on secondary market sale. More details are shared in our earlier blog : Buying Sovereign Gold Bonds : 15-Mar-23 – Aroha Capital.

Market Price and Intrinsic value of a Sovereign Gold Bonds (SGBs) : Once listed, the market price of SGBs may trade at a premium or discount to the theoretical gold value. The purpose of our study here is to understand the evolution of SGB premium/discounts over time. Physical gold and gold ETF units are directly linked to the underlying price of gold. SGBs on the other hand in addition to the prevailing price of 999 gold also generate periodic coupon cash flows to maturity. The full economic benefit of holding an SGB therefore is:

Calculation of NPVd (ie discounted future coupon cash flows of an SGB) : The NPV on a given date of all future coupon payments of a SGB is calculated as follows:

Price of 999 Gold: In the absence of published historical prices of 999 IBJA gold, daily prices used on the books of a local private gold trader was used. The prices may have errors – but we will live with these errors as there were no other free data sources.

Calculation of SGB Premiums: SGBs trade in the secondary market at prices that may differ from their theoretical gold-linked value. We attempt to capture the premium/discount of an SGB as follows :

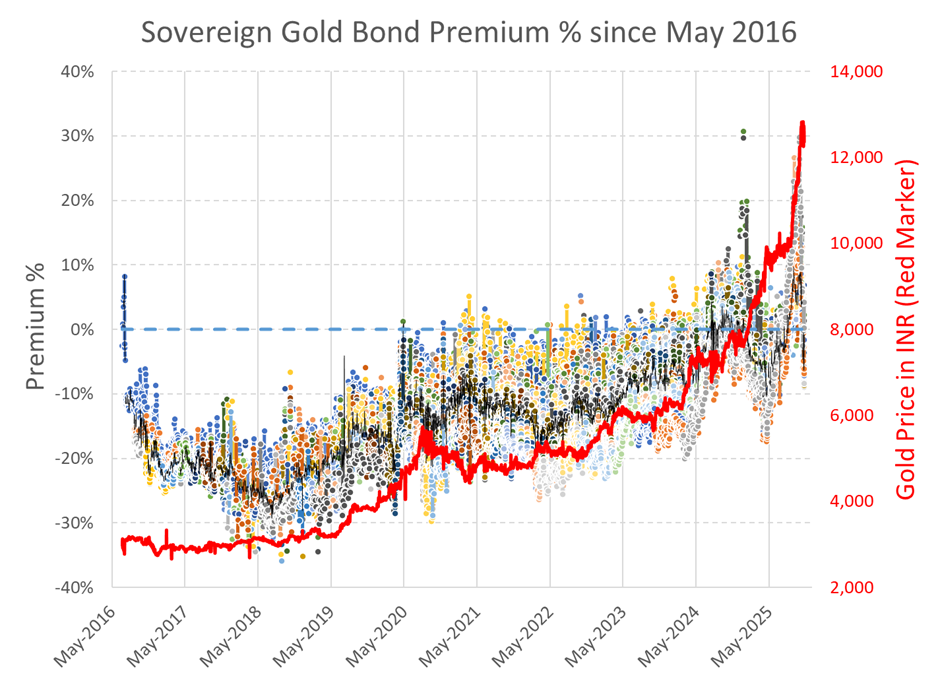

SGB Premium % versus Date:

The daily premiums/discounts in % for 57 SGBs were calculated on a daily basis. The same is shown as a graph below:

The graph plots Sovereign Gold Bond (SGB) premium % over time from May 2016 to Oct 2025. Each coloured dot represents the premium or discount (%) of an individual SGB relative to intrinsic value at that point in time. The y-axis on the left shows the premium/discount percentage, while the y-axis on the right (in red) shows the price of gold in INR.

- The black line represents the average premium (or discount) across all SGBs at each point in time.

- The red solid line represents the price of gold in INR over time (to be read from the secondary y-axis on the right)

- A blue dashed horizontal line at 0% premium marks the level at which SGBs trade exactly at parity with physical gold.

In the initial years after SGB introduction, the average premium hovered between –15% and –30%, with many bonds experiencing even deeper discounts. This occurred despite the presence of guaranteed coupons and sovereign backing. In the next phase (2019–2022), the black average line begins to trend upward, indicating a gradual reduction in discounts. This seems to coincide with steady increase in global gold prices. While discounts still persisted during this phase, they are noticeably shallower, and the dispersion across SGBs narrows. This suggests improving price discovery and growing acceptance of SGBs as a legitimate gold-linked financial asset. The most striking change occurs from 2023 onward. As gold prices rise sharply, the average SGB premium crosses zero, moves decisively into positive territory and displays greater volatility. Several individual bonds show large positive premiums, with some exceeding +30%. The dispersion widens significantly, indicating that not all SGBs are priced uniformly. A key insight from the graph is that SGB premiums are regime-dependent and strongly influenced by gold price cycles.

- When gold prices are weak or range-bound, SGBs trade at structural discounts

- When gold prices rise sharply, SGBs often trade at irrational premiums

- Gold price cycles set the valuation regime

- Average valuation masks SGB-specific extremes. While the black line provides a useful benchmark, individual bonds can deviate significantly due to factors we have still not understood.

- Market prices often diverge from fundamental value. The swing from deep discounts to the emergence of very high premiums suggests that the secondary market for SGBs is inefficient and provides scope for price discovery.

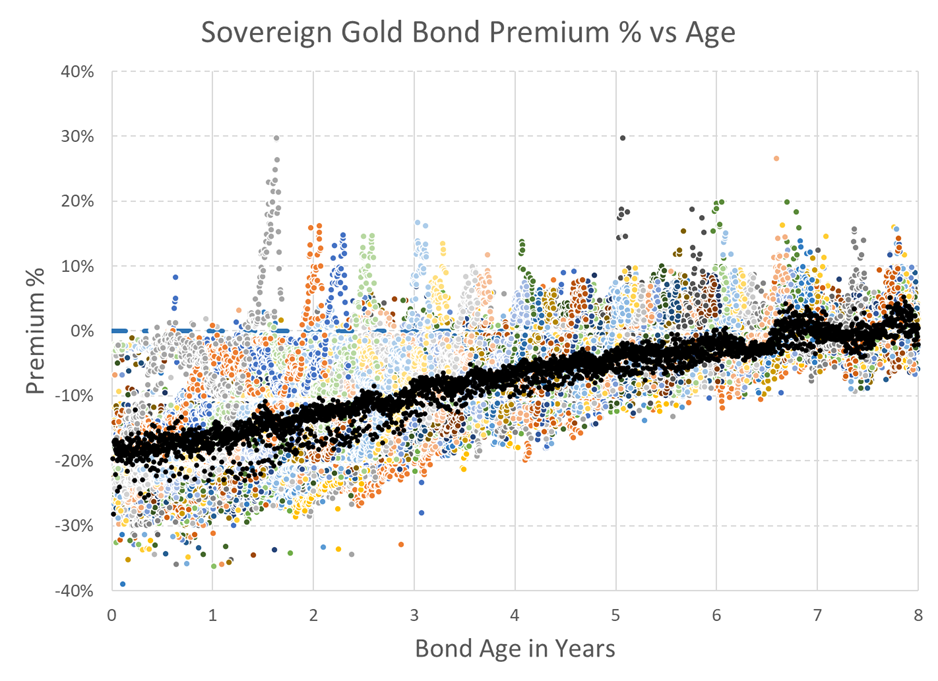

SGB Premium % versus SGB Age : To get further insight, the daily premiums/discounts in % for all 57 SGBs was plotted against each SGBs age. The graph below shows this plot.

The graph plots Sovereign Gold Bond (SGB) premiums or discounts (%) on the vertical axis against bond age in years on the horizontal axis, ranging from issuance (0 years) to maturity (around 8 years).

- Each coloured dot represents the premium or discount of an individual SGB at a given point in its life.

- The black line represents the average premium across all SGBs at each bond age.

- A horizontal blue dashed line at 0% marks parity with physical gold (i.e., no premium or discount).

Three dominant patterns emerge:

- Strong negative premiums (ie discounts) at early SGB ages

- A steady, almost linear improvement in premiums as SGBs age

- Convergence toward zero (or mild premium) near maturity

- Higher dispersion in premiums at younger SGB ages.

Together, these indicate a systematic lifecycle effect in SGB pricing. We hypothesize that long-dated SGBs suffer from higher uncertainty and illiquidity, as maturity nears, uncertainty reduces and discounts effectively compress to zero. However, the magnitude of discounts early in life suggests that behavioural and liquidity frictions are also likely factors. The graph demonstrates that SGB pricing inefficiency is not just gold price cycle dependent. It follows a clear, predictable lifecycle pattern. This makes bond age one of the most powerful predictors of SGB mispricing, alongside gold price cycles and liquidity effects.

Framework for understanding SGB market premiums:

Macro evolution (Gold Price Cycles) : Sets the baseline sentiment. Discounts in weak gold phases (2016–2018), premiums in strong phases (2024–2025). These macro swings shift the entire premium/discount curve up or down.

Micro lifecycle (Bond Age) : Deep discounts in young SGBs that steadily decays and eventually disappearing at maturity.

Interaction of macro with micro : A significant interaction effect exists between the macro and the micro cycles. Gold price momentum has a disproportionate effect on younger SGBs. As SGBs age and near maturity their susceptibility to gold price euphoria/depression subsides. When gold prices are under pressure, it likely that younger SGBs will have the highest discounts, and when gold prices are euphoric, it is most likely that younger SGBs will have the highest premiums.

Clearly this framework does not account for all the variation seen in SGB premiums. Nevertheless, it explains at-least in part the irrational swings we have seen in SGB premiums – from 30% discounts to 30% premiums. The current prices in gold would indicate we are at euphoric levels – it is very likely that at-least some SGBs will be trading at high premiums to their intrinsic values and hence must be avoided. The secondary market investor in SGBs must tread with care.