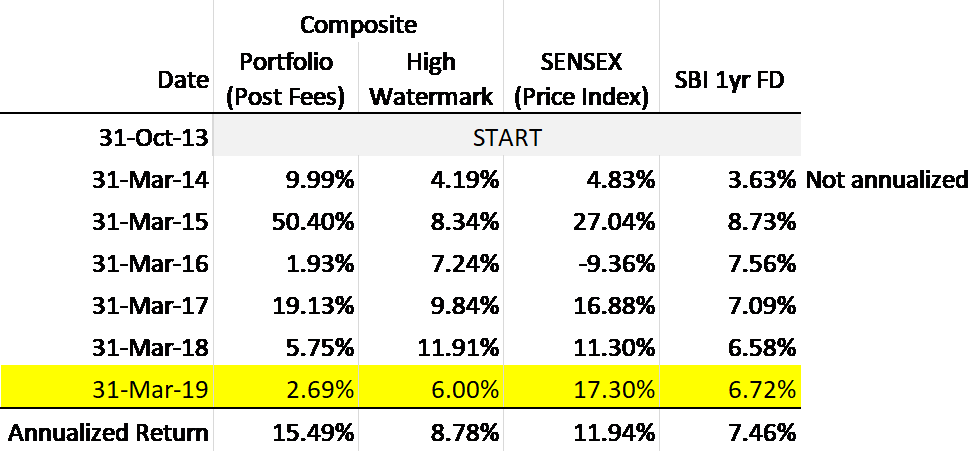

The financial year 2018-19 has just ended. The year gone by has witnessed stellar growth in the headline BSE SENSEX. The wider market however has lagged these indices. We present Aroha’s performance over the past one year as follows :

The composite portfolio is comprised of a variety of individual portfolios benchmarked either to the SBI ONE YEAR FD rate, the BSE SENSEX Price Index or the BSE SMALL CAP Price Index (based upon the investment policy statement of each individual customer). The composite portfolio is constructed by simply summing up the net asset values of all individual client portfolios. The composite highwater mark is constructed by weighting each of the above-mentioned indices in proportion to the assets under management of each individual index. The above table indicates one more year of pretty dismal performance at a composite level. Nevertheless, a dissection of the individual portfolios indicates that nearly ALL underperformance in the year gone by has been generated in portfolios benchmarked against the BSE SENSEX Price Index. In-fact, there has been reasonable outperformance in portfolios benchmarked against the SMALL CAP Price Index and relative stable performance in portfolios benchmarked against the SBI ONE YEAR FD rate. Nevertheless the historical underperformance in the SMALL CAP Price index continues and we believe it is a matter of time before our clients who have chosen exclusive exposure to our basket of risky ideas, begin to see a modicum of outperformance.

As we indicated in our blog of Emerging Value : 28-Feb-19, we believe that many stocks in the broader market, especially those in our basket of risky ideas are significantly under-valued. It is our understanding that many of these stock ideas are braised for sudden large upswings based upon expected events pertaining to their individual businesses. We will await for the unfolding of these price triggers in our basket of risky ideas . In the meantime, we continue our strategy of low churn, gradual allocation and accumulation with cash on the side (portfolios permitting) and giving a long rope to the managers of businesses (amongst our risky basket), in charting the course ahead.

In the year gone by, we completed 5 years of being a SEBI Registered Investment Adviser. We renewed our Investment Adviser licence in October 2018 for another 5 years. While customer portfolios have performed reasonably well vis a vis their benchmarks over the past 5 years, an honest appraisal of Aroha's business would indicate that we have not done as well as we should have. We look at the last 5 years as putting in place the building blocks for a best in class investment advisory practice based upon fiduciary principles and true skin in the game. Thank you dear clients for one more year of faith reposed in us. We believe our patience will reap rich dividends in the years ahead.